Introduction

Dear Readers, Pakistan’s new energy vehicle (NEV) market is finally gaining momentum. After years of speculation and early experiments, major players are now launching or assembling four-wheeled NEVs locally. These companies include Mega Motor (with BYD), Sazgar, Capital Smart Motors (CSM) partnering with Geely, the Nishat Group / Chery (Omoda and Jaecoo), MG Pakistan, and even Dongfeng through future partnerships. This article provides an in-depth look at the types of four-wheel NEVs being introduced, their likely market share, which segments they suit, and what buyers should think about before making a purchase.

Types of Four-Wheel NEVs in Pakistan

Here’s a look at the major NEV players in Pakistan and the types of four-wheel vehicles they are bringing in or assembling.

- Mega Motor / BYD

- Partnership: Mega Motor Company, a subsidiary of Hub Power Company (HUBCO), is working with BYD.

- Models: BYD has launched models like the Atto 3, Seal and Shark in Pakistan.

- Assembly: They plan to locally assemble NEVs; an assembly plant is set up by 2026.

- Ambition: According to Mega Motor / BYD, NEVs could make up as much as 50% of Pakistan’s vehicle sales by 2030.

- Market share target: BYD aims for around 30–35% share of the NEV segment in Pakistan.

- Sazgar Engineering Works

- Background: Historically known for rickshaws, Sazgar holds ~30% of the local rickshaw market.

- NEV Plans: Sazgar is building on its legacy to produce electric three-wheelers (e-rickshaws).

- Four-Wheel NEVs: They have also announced plans to assemble hybrid / electric four-wheelers; e.g., they had a joint venture with Great Wall Motor for hybrid vehicles.

- Timeline: According to local sources, their NEV four-wheeler rollout is expected around March 2026.

- Capital Smart Motors (CSM) / Geely

- Partnership: CSM (a venture of Habib Rafiq Engineering Ltd.) has signed an MoU with Dongfeng & Geely Auto Group.

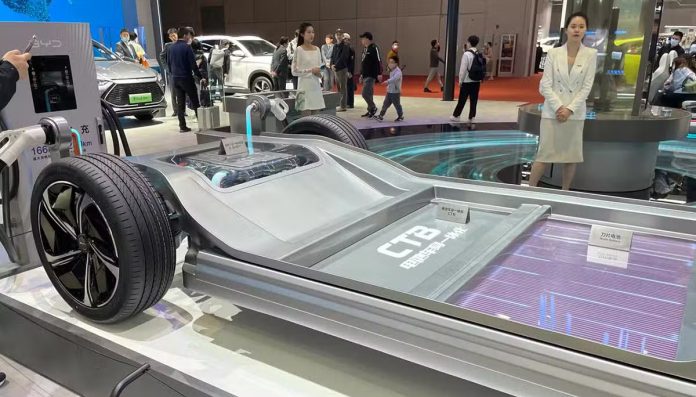

- Brands & Models: CSM is bringing in Forthing Friday, Geely Zeekr (premium EV), Riddara (electric pickup), and Farizon (commercial EV).

- Specific Launches: In October 2025, CSM launched six EV models: Zeekr 009 (MPV), Zeekr X, Zeekr 7X, Forthing Friday REEV, JMEV Elight, and Riddara RD6.

- Specs Example: The Riddara RD6 pickup comes in variants (2WD / 4WD), with a reported range of ~373–455 km (CLTC cycle).

- Nishat Group / Chery (Omoda and Jaecoo)

- Partnership: Nishat Group’s NexGen Auto is collaborating with Chery International to launch Omoda and Jaecoo brands in Pakistan.

- Models Introduced: Omoda E5 (fully electric) and Jaecoo J6, J5, J7 etc.

- Investment: Nishat is investing ~$100 million into a manufacturing facility near Faisalabad for assembly.

- Variants: According to prior reports, they will launch EV and PHEV (plug-in hybrid) models: e.g., Jaecoo J7 REEV PHEV.

- MG Pakistan

- Status: MG has already shown interest in NEVs, especially in hybrid and plug-in hybrid models.

- Model Example: MG HS PHEV is reportedly one of their NEV/hybrid offerings.

- Market Presence: According to media, MG claims to be among the top NEV / hybrid brands locally.

- Dongfeng NEV Distributors

- As of now, there’s limited clear public information about Dongfeng assembling NEVs in Pakistan under local partnerships. There have been mentions in the user prompt, but I found no credible public source confirming a major four-wheel NEV rollout by Dongfeng in Pakistan by 2025.

Estimating Market Share — Current & Future Outlook

Quantifying precise current market share by each NEV assembler in Pakistan is challenging due to the nascent stage of NEVs and limited publicly disclosed sales figures. However, based on available data and strategic projections, we can provide a reasoned analysis:

- Mega Motor / BYD: As one of the first major NEV entrants, BYD (via Mega Motor) is likely to capture a significant portion of the NEV segment — their own target is 30–35% share.

- Capital Smart Motors (Geely): Given its aggressive six-model launch in 2025, CSM could secure 20–25% share of early-adopter NEV buyers, especially in premium and utility segments.

- Nishat / Chery (Omoda & Jaecoo): With local assembly investment ($100M), they are positioning to serve both mid and upper segments — potentially 10–15% share initially, growing as infrastructure builds.

- MG Pakistan: MG’s hybrid / PHEV market share could remain in the 10–20% range in the NEV category, especially among consumers hesitant about full EV infrastructure.

- Sazgar: While dominant in three-wheeler EVs / e-rickshaws, its four-wheel NEV share is likely modest in early years, perhaps 5% or less, unless they scale assembly rapidly.

These are rough estimates, based on company ambition, local partnerships, and market trends. Given that NEV adoption in Pakistan is still in early stages, these shares could shift rapidly depending on infrastructure, policy, and consumer uptake.

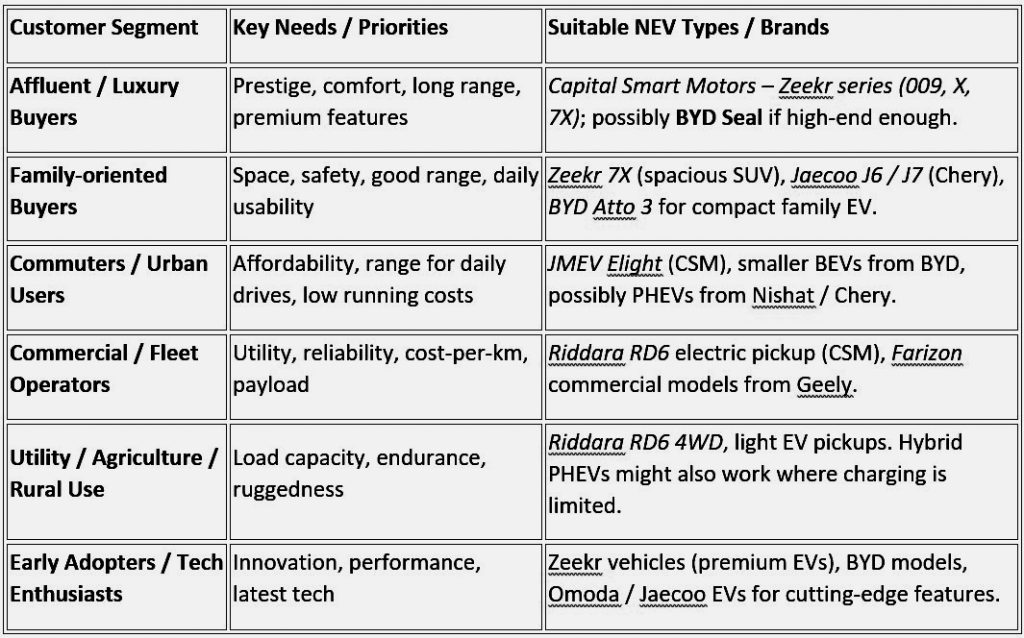

Customer Segments and Suitable Vehicle Types

Different NEV types appeal to different customer segments. Here’s a breakdown of likely customer segments in Pakistan and which NEV types / brands might suit them.

Key Factors Potential Buyers Should Consider Before Buying a NEV / Brand

If you’re thinking of buying a four-wheel NEV in Pakistan, here are the most important factors to evaluate — plus brand-specific considerations.

- Charging Infrastructure

- Check the availability of charging stations in your city / route.

- For full BEVs, reliable charging is crucial; PHEVs (or range-extended EVs) offer flexibility where charging is limited.

- Total Cost of Ownership (TCO)

- Beyond sticker price: factor in electricity costs, repair / maintenance costs, battery warranty.

- Compare with hybrids and ICE cars — sometimes PHEVs may offer a better TCO if infrastructure is weak.

- Range & Performance

- Assess real-world driving range (not just manufacturer claims) under Pakistani conditions.

- Consider driving habits: city driving favors EV; highway or long trips may benefit from PHEV.

- Service & Maintenance Network

- How strong is the service network for that brand? (e.g., Geely via CSM, MG’s existing network, BYD via Mega Motor).

- Availability of spare parts, trained EV technicians, and battery-related service is critical.

- Resale Value

- As NEVs are new in Pakistan, resale dynamics are uncertain. Brands with strong reputation = potentially better resale.

- Brand Reputation & Support

- Local assembly vs imported (CBU) matters: local assembly often means lower costs & better service.

- Warranty on battery packs, EV-specific components (motors, inverters) is very important.

- Policy / Incentives

- Check relevant NEV policy incentives, import duties, tax breaks.

- Government policies may evolve; early buyers should be aware of any future risk.

- Safety & Features

- Look for ADAS (Advanced Driver Assistance Systems) features, crash safety.

- Technology features (infotainment, battery management) differ by brand; prioritize based on needs.

- Financing Options

- Are there EV-friendly financing options in Pakistan?

- Insurance costs for NEVs vs conventional cars.

Risks & Challenges for NEV Adoption in Pakistan

While the NEV market is promising, there are several risks that potential buyers and investors must be aware of:

- Charging Infrastructure Gaps: Despite growth, public charging remains underdeveloped in many parts of Pakistan.

- Electricity Costs / Reliability: Even if charging is available, consistent power supply and cost per kWh will impact running costs.

- Battery Degradation: Over time, batteries degrade, and replacement / maintenance costs can be high.

- Policy Risk: NEV incentives, duties, and import conditions may change.

- Market Liquidity / Resale: As NEVs are new, used NEV market is limited; resale risk is higher.

- Consumer Awareness: Many buyers may lack understanding of EVs, leading to lower adoption or unrealistic expectations.

- Supply Chain / Localization: Local assembly may take time; imported CBUs could remain expensive in the short-term.

Strategic Outlook & Future Trends

- Localization Push: With local assembly certificates being issued (for plug-in hybrid SUVs and NEV cars) per Pakistan’s NEV policy, the country is making a push toward localized production.

- Charging Network Expansion: As NEV adoption grows, we can expect partnerships for charging infrastructure (e.g., between Mega Motor / HUBCO and oil marketing companies).

- Diversified NEV Portfolio: With players like CSM bringing in SUVs, MPVs, pickups, and compact EVs, the NEV market is no longer niche — it’s becoming broad-based.

- Commercial EVs Growth: Brands like Geely (via Farizon) may bring in commercial EVs (light trucks, minibuses), which could be very relevant for logistics, public transport.

- Consumer Education: To drive adoption, consumer education will be critical — buyers need to understand benefits, costs, and trade-offs.

Conclusion

Pakistan’s NEV journey is unfolding in earnest. From Mega Motor / BYD building its first locally assembled plant, to Capital Smart Motors launching six EVs across different categories, to Nishat Group partnering with Chery for Omoda and Jaecoo — the ecosystem is expanding fast. While MG leverages its existing market presence with hybrid NEVs, Sazgar brings its manufacturing experience to both three- and four-wheeled EVs.

For potential buyers, the choice will depend heavily on purpose (commuter vs utility), budget, access to charging, and willingness to adopt new technology. With the right decisions, NEVs in Pakistan can offer cleaner, more efficient transportation — but navigating this emerging market requires careful consideration.

This exclusive article has been published in Automark’s December-2025 printed and digital edition. Written by #Aqeel Bashir