Investment plans of other new entrants look intact so far. They look more determined to shake up dominance of three Japanese assemblers

The PML-N government had introduced the Auto Policy 2016-2021 in good spirit to break the monopoly of existing Japanese assemblers and bring a variety of European, Korean and Chinese brands for the consumers.

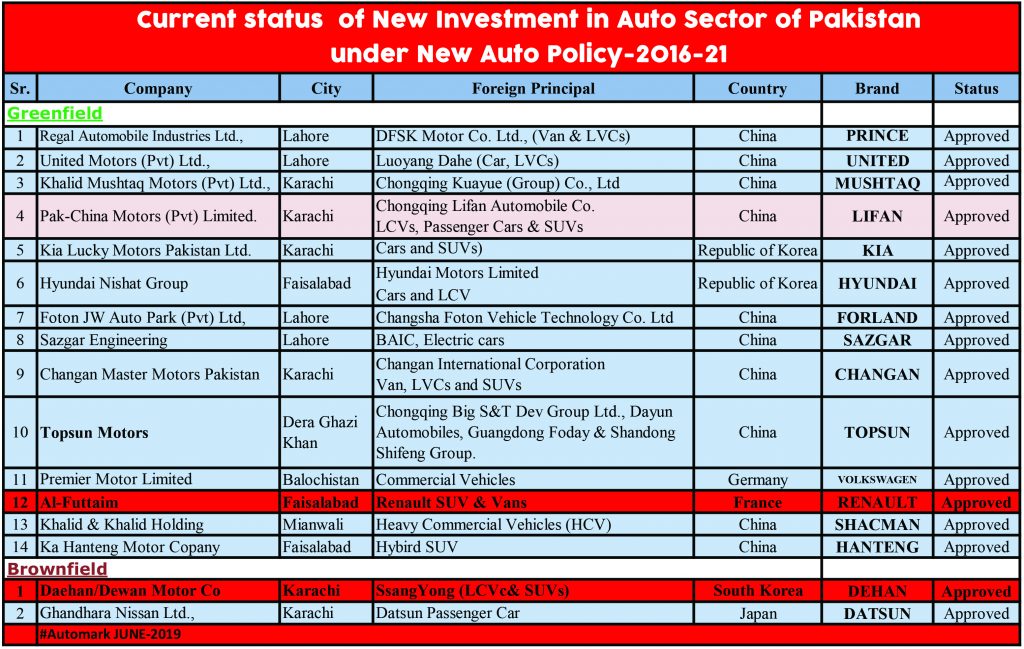

All was going well with arrival of 17 new entrants (15 in green field and two in brown field) carrying an investment of over one billion dollar for creating additional capacity of 300,000 units (cars, LCVs and SUVs).

The positive response shown by new investors towards the auto sector reminds of the Musharraf era when he opened the bike market for new players to jolt market leadership of Atlas Honda Limited (AHL).

The Musharraf government opened a floodgate for Chinese bike assemblers resulting in arrival of over 100 assemblers in Zardari and Nawaz Sharif periods but now only 20 units are enjoying the field day while 20 others are struggling for their survival. Many bike factories still exist but they have suspended their production owing to stiff market conditions.

However, influx of Chinese bike provided a big relief for low and middle income people because of cheap price compared with Honda CD70cc but this could not really seriously hit Atlas Honda Limited, who is still market leader with over half of the total bike volume amid very high price. This means that Honda bikes virtually rule in rural areas of Punjab and Sindh mainly because of its durability and quality.

Coming back to Auto Policy 2016-2021, auto market has shaken with hovering dark clouds over $165 million Al Futtaim-Renault green field project as market pundits see the above project as “First casualty of the Auto Policy” despite no official confirmation from the two companies.

Market is also abuzz with reports that two more new entrants have yet to receive green field status either they have backed out or adopted wait and see attitude for some other reasons.

People have welcomed Chinese bikes because of low prices but the case of cars is different. Pakistani customers have yet to develop any liking for Chinese cars despite the fact that some Chinese assemblers are faring well in light commercial vehicles because of price advantage.

Many people feel that European cars do excel in quality and durability but their high prices cannot compete with Japanese and Korean cars. Again consumers’ choice for European brands holds a big question.

To some extent, Korean cars had also failed to carve a niche among people but here Dewan Farooqui Motors Limited can be blamed for mismanaging Hyundai and Kia a decade back. Now two big groups – Nishat with Hyundai and Lucky group with Kia – are coming up but they will face a tough challenge to lure buyers.

If massive rupee devaluation against the dollar from January 2018 till to date coupled with ailing economic indicators can be blamed for Al Futtaim Renault debacle then why other assemblers especially Korean and Chinese are not feeling the pinch of soaring project cost.

Reports of Nissan and Renault tussle after their Chairman Carlos Ghosan’s money embezzlement scrutiny might have put Renault in a precarious situation to be very careful in entering any other country.

Market reports say that Al Futtaim, the operators of Al Ghazi Tractors in Pakistan, may not be interested any more in going forward with Renault due to project’s risky and bleak prospects.

Surprisingly, French Senator, Pascal Allizard, leading a three member French Parliamentary Group, had said last month in Islamabad during a press conference that French automobile maker Renault was keen to set up a manufacturing plant in Pakistan. Interestingly, he did not disclose any thing about the joint venture of Renault with Al Futtaim for vehicle assembly at Faisalabad plant.

Before acquiring land in Faisalabad, Renault’s aim to start local assembly in Pakistan had faced a number of challenges from 2016. In November 2017, the French auto maker, after suspending talks with Ghandhara Nissan Ltd (GHNL), made another attempt in December 2018 to assemble and distribute its vehicles in Pakistan in partnership with Al Futtaim, a Gulf-based business house.

Groupe Renault and Al-Futtaim had signed definitive agreements to assemble vehicles in a new plant in Karachi. The two parties expected that the plant would be built starting the first quarter of 2018. Project was shifted to Faisalabad special

economic zone from Karachi. Before the project between gulf and France kicked off in Faisalabad, a number of people working with Al Futtaim Renault project are either left their job or searching new jobs since the project has been going at snail’s pace thus causing anxiety among the staffers and market watchers.

Surprisingly, Board of Investment (BoI), Engineering Development Board and a senior executive at Al Ghazi Tractors, who is looking after the project as its head, had played safe. BOI minces words in saying it is yet to get any confirmation from Al Futtaim regarding reports of pull back or delay about the project.

Faisalabad Industrial Estate Development and Management Company official says the UAE Company had purchased land at M-3 Industrial City, Faisalabad in May, 2018 to establish plant to assemble-cum-manufacture Renault cars. Aimed at creating 500 jobs, the company has not started any construction work so far at its 67 acres of land. The land has so far been intact, he says to local English daily adding that he does not have any confirmation regarding pull back or delay by Al Futtaim.

Sources in the auto sector said the Al Futtaim Renault issue has been highlighted before the Prime Minister Imran Khan last month by concerned government departments dealing with Al Futtaim. They said PM has taken asked the concerned departments to remove any bottlenecks at the government’s end to save a huge investment in the auto sector.

Perhaps another issue that haunts Al Futtaim Renault is over 300,000 units of additional capacity coming up in the next one to two years in which new entrants will make die hard effort to grab a share. With lowering volume of used car imports following government’s stric regulations, new entrants can fill the vacuum of 70,000-80,000 units but starting with low volume and existence of well established three Japanese players may pose a serious challenge to new entrants to stay floating in the competition.

Some new entrants believe that the government should avoid giving green signal to more new players while others say that let the market decide the fate of new entrants. Influx of 15 new entrants in the green field and two in brown field under Auto Policy 2016-2021 may create a difficult working environment in the short term for new entrants in grabbing a slight slice of market share from three big Japanese giants.

Low localization level at the start of assembly by new entrants means opening of few new jobs at the assembling units and offices instead of big job opportunities at the vendors’ end. Accelerating localization level in the locally assembled vehicles will take considerable time depending on the response of consumers towards new vehicles.

One new entrant believes that 17 new players are too much in Pakistan, if they all materialize. Country’s installed capacity will double if all the new players were to establish and go forward with their plans. He urged the Government to prevent the creation of a huge over-capacity which will only result in a bloodbath among manufacturers and will not be conducive to localization. The government should keep the ADP 2016-2021 policy framework intact with no extension.

Another big challenge for the new entrants is their vulnerability towards exchange rate impact. Starting car assembly with very few locally made parts means hovering pressure of frequent price shocks to the consumers if losing value of the rupee against the dollar continues. Hence localization is essential even with low volumes.

Let’s discuss status of some new entrants

Regal: Regal Automobile is currently assembling 1,000cc mini van and loader. The company has imported 800cc four wheeler passenger cars from China – Prince Pearl to test its marketing response. The company aims to assemble it locally next year without announcing any price yet.

United: United Bravo 800cc car has already been put on sale but it is not visible on the roads specially in Karachi.

Khalid Mushtaq: The construction work of Khalid Mushtaq Company has almost completed while the company has imported 40 units of Mushtaq KY 10 trucks in CBU form out of 100 units allowed under auto policy. More 60 units will arrive in next phase. The company plans to assemble by end of 2019. However, dealer network is being established slowly.

The company claims to have received good feedback from the dealers and customers Price is also acceptable as with this specifications other truck is not available currently in local market neither from China, Japan or Korea.”We are very hopeful for our product,” COO of the company Anwar Iqbal says.

Specification of the product: Powerful VVT Technology Gasoline Engine, Power: 110 HP / 82 KW, Torque: 143 NM, Displacement: 1.5 L. Best in Class Fuel Efficiency (100km/=8.8L at Speed 50km/h), Euro-4 Technology Engine For Cleaner Emissions and Thick & Strong Elevated Muffler.

KIA Lucky: Kia Lucky Motors is coming back in the local industry of Pakistan with KIA Picanto 2019 after a decade. It also displayed a number of vehicles at 3-day auto event Auto Parts Show (PAPS) 2019 held in Expo Centre, Karachi where it presented as many as five of its vehicles including Stinger, Picanto, Sportage, Nori and Grand Carnival.

Local assembled KIA Sportage and Picanto will be available in Pakistan and expected to release in June and October respectively. The booking of the vehicles will start in June and August 2019 respectively and the delivery is anticipated in end July and October of this year respectively.

KIA has set up an assembly plant and installed assembly line to assemble these two vehicles at their Port Qasim assembly plant in Karachi. KIA Picanto is an entry-level 5-door hatchback powered by 1,000 cc engine displacement mated with a 4-speed automatic gearbox. The Euro-6 compliant 1.0-litre engine produces a maximum output power of 66 hp. The hatchback has a wheelbase of 2400 mm which provides optimum control over the car.

The hatchback comes in 1.0-litre engine mated with a 5-speed manual transmission and a 1.2-litre engine which is offered under the optional automatic transmission. The upcoming car is also equipped with airbags as a basic safety feature but lacks the spare wheel at the back which is a necessity especially while traveling in Pakistan.

The company claims that they will offer a version of Picanto which will have many more additional features as compared to the one showcased at PAPS 2019. The estimated price of the upcoming entry-level hatchback is Rs.1.2-1.5 million.

Hyundai Nishat: The construction for an assembly plant of Hyundai Nishat Motors is almost done. The company will introduce four variants in CKD but the company has kept it secret for all models and variants so far. By November-2019, products will be available for test and trial. While already giving orders for CKD for different variants, the company has already assigned eight to nine dealers across the country. Production will get underway from 2020.

JwForland: JwForland has so far been going well as it is producing five variants in Pakistan. Recently, JwForland celebrated its achievement of assembling 500 trucks in Pakistan.

Prime Minister of Pakistan Imran Khan inaugurated phase 1 production facility of JwForland truck assembly plant in Lahore. CM Punjab, Governor Punjab, Information Minister and many other high level government officials were with him on that special visit and on ceremony.

Sazgar: The construction of Sazgar assembly plant is almost completed but the company is unhappy with rupee devaluation against the dollar. However, the company has imported few vehicles for testing and marketing. According market source quality of the vehicles are very good.

MML: Master Motors Ltd (MML) has rolled out its first locally assembled vehicle Changan Karvaan on May 2, 2019 in just 13 months, which is record time for any Greenfield auto manufacturing plant.

It is pertinent to mention here that Master Motor Ltd is a joint venture between Master Motor Corporation Ltd. and Changan International Corporation. The company announced local production of three Changan vehicles in Pakistan, namely Changan M8 Pickup, Changan M9 Pickup, and Changan Karvaan van, followed by full range of SUVs, MPVs and other passenger vehicles.

KKH: Khalid & Khalid Holding representative said the company would introduce trucks, buses and trailers while the company has already sold 1,200-1,400 CBUs trucks.

Production will start next year at Adam Khail near Mianwali where shade was almost done. Equipments will arrive by end of this year.

KA Hangtang: (Faisalabad M3) has already imported few EV SUV cars for testing and marketing and had good feedback from investors. After recent announcement of PM about electric cars, the company is waiting for some good news and welcome the government decision.

The company is very much interested to produce EV SUV and HEV (Hybrid Electric SUV) in Pakistan. Production will start next year but construction has not yet started.

Topsun Motors:

Topsun Motors Pakistan has accrued 60-acre land in Sakhi Sarwar, District Dera Ghazi Khan, close to Al GHAZI TRACTOR, and civil work is in progress by the Chinese company. Trail Production will start by June 2020. All investments will be arranging by TOPSUN Motors Pakistan and our overseas partner will assist u in technical issues only. CBU units will be available from August 2019 most probably.

Premier Motor Limited:

Government awarded the ‘category-A Greenfield investment status’ to a Karachi-based Premier Motor Limited for assembling /manufacturing of vehicles covered under its contract agreement Volkswagen in April-2019. German automaker Volkswagen has planned to invest $135 million.

The plant would be set up in Balochistan and a land has already been acquired. Since the company has been awarded the status, it would now start construction on the site. The plant would become operational in 2021 and would initially manufacture vans and double cabin vehicles.

This article has been published in Automark Magazine June-2019 printed edition