Economic Overview

Mexico is recognized as one of the most open economies in the world, boasting an extensive network of Free Trade Agreements (FTAs) that provide access to 50 countries. This network makes Mexico a vital player in global trade. Key FTAs include:

- Pacific Alliance FTA: Covers 41% of Latin American and Caribbean GDP ($2,707 billion).

- European Union FTA: Represents 22.9% of the world’s GDP ($19,974 billion).

- USMCA (United States-Mexico-Canada Agreement): Comprising 28% of global GDP ($24,440 billion).

- Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP): Covers 12.9% of global GDP ($11,262 billion).

As the 2nd largest economy in Latin America after Brazil, Mexico’s GDP stands at $1.27 trillion. Despite ranking second in terms of GDP, Mexico is Latin America’s leading exporter, responsible for a third of the region’s total exports.

Automotive Industry Growth in Mexico: Implications and Opportunities

Mexico’s rapid growth in the automotive industry has implications across the value chain. Economic developers in the United States and Canada often view Mexico as a competitive threat due to potential shifts in automotive investments southward. However, many automotive firms in the U.S. and Canada depend on Mexico as part of an integrated supply chain, serving both as a source of inputs and as a destination for outputs.

Mexico’s automotive industry has become a hub for international automotive investments. As companies seek to establish or expand operations in North America, Mexico is increasingly being viewed as a prime location for new facilities. While the country offers numerous advantages, not every operation is suited for Mexico, and some suppliers may find it difficult to establish a presence due to local market dynamics or the specific needs of their clients.

Mexico’s Automotive Aftermarket: A Sector Poised for Growth

The Mexican automotive aftermarket presents significant growth opportunities, particularly as millions of passenger vehicles are now out of warranty in 2023. The population of these out-of-warranty cars is expected to grow at a robust CAGR from 2023 to 2031, creating substantial demand for replacement parts.

The Mexican automotive aftermarket is segmented by vehicle type, replacement parts, and certification:

- Vehicle Type: Divided into passenger vehicles and commercial vehicles.

- Replacement Parts: Includes a wide range of products such as tires, batteries, brake parts, filters, lighting components, electronic components, lubricants, clutch parts, engine components, and more.

- Certification: Products are categorized as genuine parts, certified parts, and counterfeit parts.

This segmentation highlights the variety of products and services in demand, positioning Mexico as a key market for both domestic and international suppliers.

Key Economic Indicators

- Population: 130 million

- GDP Annual Growth: 3.23%

- GDP Per Capita: USD 10,482

- Inflation Rate: 5.53%

- Interest Rate: 10.50%

- Government Debt to GDP Ratio: 48%

- Import Tariffs: 1% to 6% (varies by parts)

- Exchange Rate: I USD = 19.89 Mexican Peso

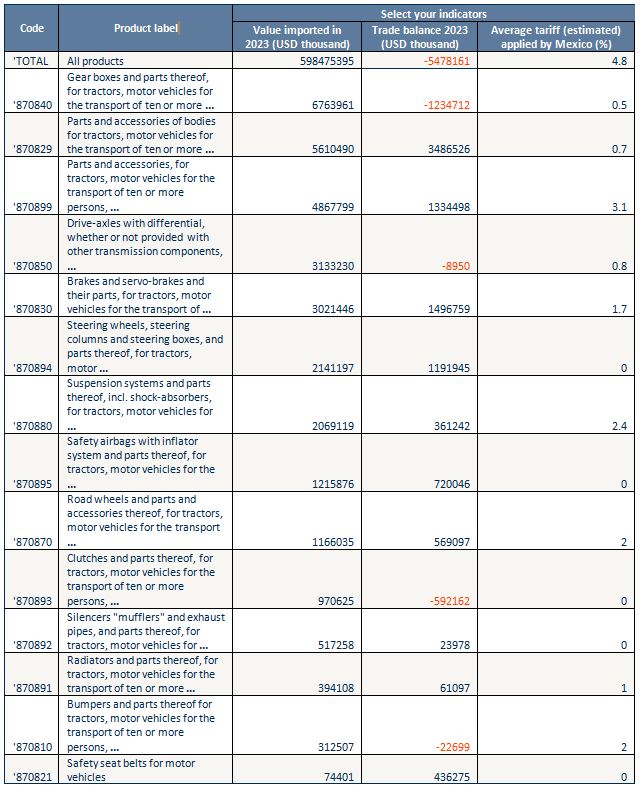

| List of products at 6 digits level imported by Mexico in 2023 |

| detailed products in the following category: 8708 Parts and accessories for tractors, motor vehicles for the transport of ten or more persons, … |

| Sources: ITC calculations based on UN COMTRADE statistics. |

Transportation Options Between Pakistan and Mexico

By Air:

There is at least 1 airline operating flights between Jinnah International Airport (KHI) and AeropuertoInternacionalLIc. Benito Juarez (MEX). The typical flight duration is approximately 1 day 6hours, including layovers. A notable advantage for travelers with a U.S. visa is that Mexico offers the convenience of visa-on-arrival, making the journey smoother for those who meet this requirement.

By Sea:

For shipping goods, the shortest sea route from Port Qasim (PKBQM) in Karachi to Veracruz (MXVER) in Mexico takes about 39 days and 19 hours. This route offers reliable options for transporting cargo between the two countries.

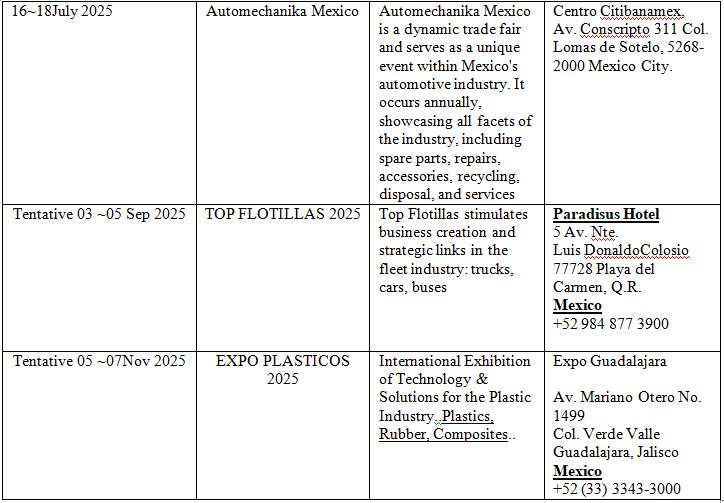

Key Events in MEXICO 2025

Upcoming Exhibitions

Conclusion

Mexico’s economic openness, strong trade agreements, and growing automotive industry make it an attractive destination for international investment. The automotive aftermarket, in particular, presents a thriving opportunity for growth as the country’s fleet of aging vehicles drives demand for replacement parts. For businesses looking to capitalize on Mexico’s dynamic market, understanding the local automotive landscape and leveraging the country’s trade advantages will be key to long-term success.

Mexico’s combination of open trade policies, strategic FTAs, and a booming automotive aftermarket underscores its position as a global economic and industrial powerhouse in the Latin American region.

By Mashood Khan – Director – Mehran Commercial Enterprises – Expert Auto Sector / Former Chairman PAAPAM

Article published in Automark Magazine’s October-2024 printed/digital edition