The Chilean auto parts industry thrives amidst the country’s burgeoning automobile sector, serving a population of 19.6 million with 5.5 million vehicles. With limited local production, the market heavily relies on imports from global partners, constituting approximately 85% of its composition.

Segmented into categories for light and heavy vehicles, the sector offers a diverse range of products, including tires, filters, screws, CV joints, and gearboxes. Despite the presence of over 60 brands from various countries, U.S. parts lead the market, capturing a significant share of imports.

Key players such as Chevrolet, Suzuki, Kia, Hyundai, Nissan, and Toyota dominate sales, reflecting intense competition and a preference for maintaining used vehicles, which constitute an estimated 37% of the country’s automotive fleet.

Quality remains paramount in consumer choices, with durability often outweighing price considerations. As the Chilean auto parts market evolves, manufacturers and suppliers have ample opportunities to cater to the diverse needs of consumers in this dynamic sector.

Key Economic Indicators:

Population: 19.6 million

GDP Annual Growth: 2.3%

GDP Per Capita: $15,355

Inflation Rate (Average, Last 10 Years): 4.1%

Interest Rate (Average): 4.5%

Government Debt to GDP Ratio (Average): 25%

Exchange Rate: 1 USD = 939.79 Chilean Peso

Import Tariffs: The U.S.-Chile Free Trade Agreement (FTA) ensures duty-free trade, with limited exceptions.

Opportunities:

Aftermarket parts and accessories market, with 80% dominated by non-branded or generic imports.

Transportation:

Plane travel from Pakistan to Chile takes about 1 day 10 hours, while sea

shipping requires approximately 48 days 7 hours.

As the Chilean auto parts market continues to expand, stakeholders are well-positioned to capitalize on emerging opportunities and contribute to the sector’s growth and development.

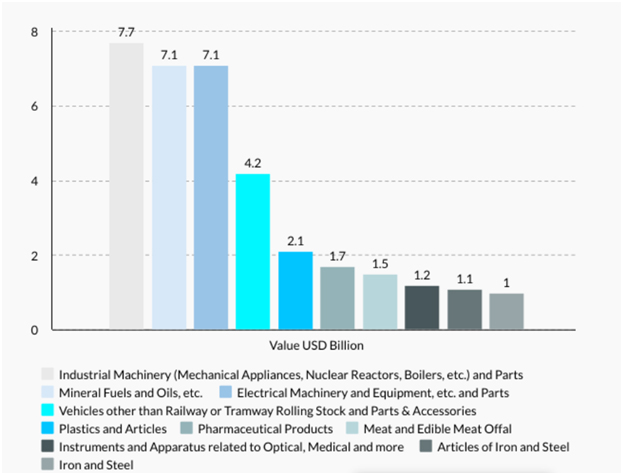

What are the Major Imports of Chile?

Source: exportgenius.in

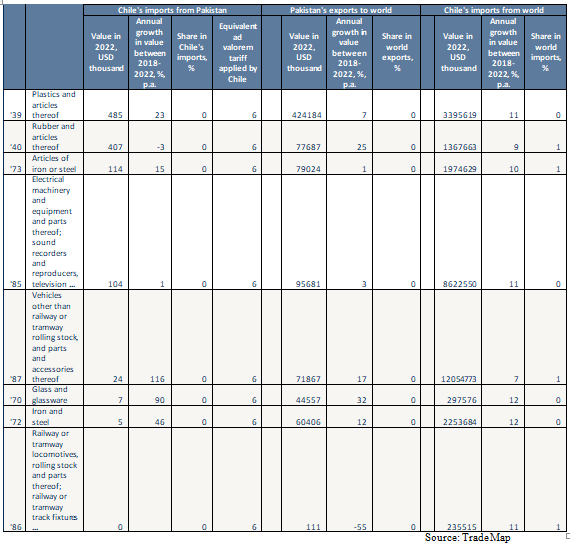

Bilateral trade between – Chile and Pakistan in 2022