How a Local Company is Preparing Pakistani Auto Industry

Energy used for Compressed Air can account for up to 72% of the electricity used in the Auto industry. In order to keep costs in control and stay competitive, Compressed Air merits serious attention.

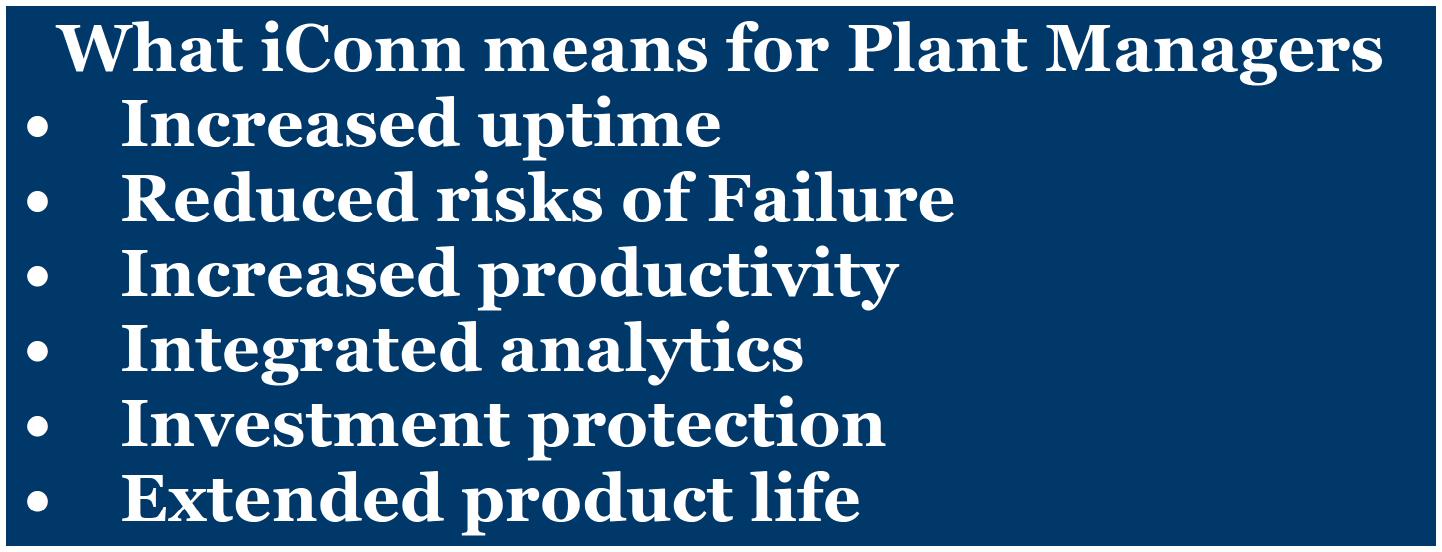

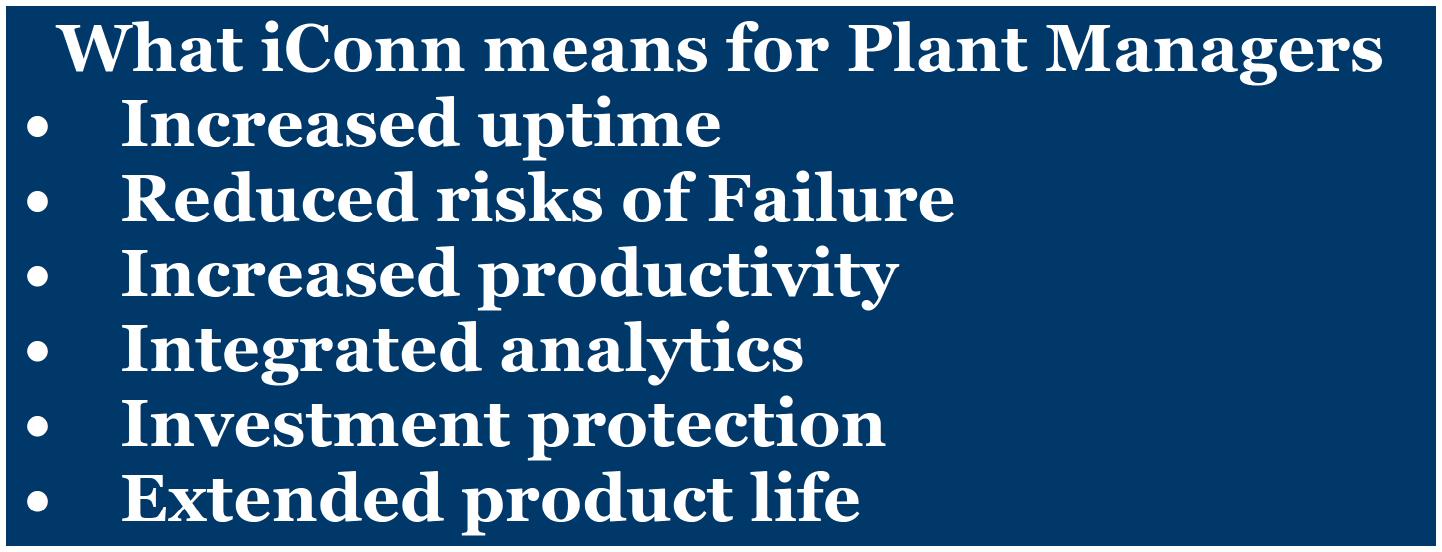

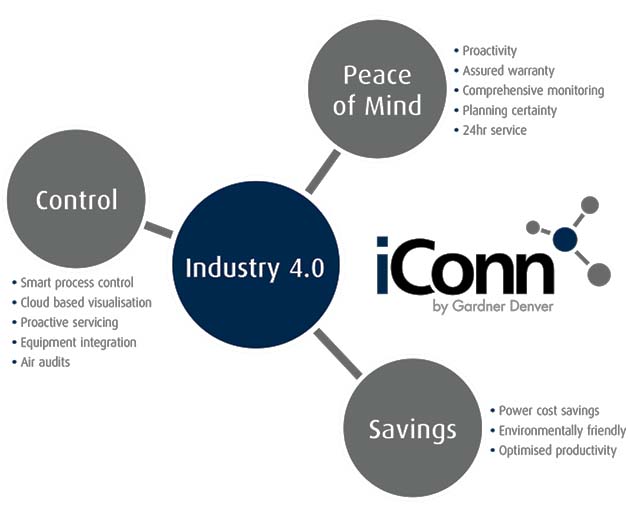

The new iConn service from CompAir provides compressed air users within-depth and real-time knowledge about their system, essential for accurate production planning, reliability and peace of mind. The iConn system generates and delivers insight and statistics that keeps compressed air managers informed of the performance of their installation, highlighting potential issues before they become a problem

Compressor performance has a key role to play in the overall cost efficiency and productivity of a process or plant. Industry figures estimate that many compressed air systems can waste up to 30% of the compressed air through leaks, poor control or maintenance. Add to this the fact that the older the machine the less energy efficient it is likely to be and it becomes clear that implementing a thorough maintenance programme can pay quick dividends.

Choosing the Correct Program

Typical maintenance cover can range from reactive or breakdown maintenance, where the compressor is left to run until any fault is identified and subsequently repaired, through to predictive maintenance, where sensor devices provide data to help predict when maintenance is required or when a part may be under stress and could fail.

An independent survey indicates that a comprehensive planned maintenance system, whereby maintenance is carried out at scheduled intervals, can result in a 70-75% elimination of breakdowns, a 35-34% reduction in downtime and a productivity increase of up to 25%.

Further improvements can be made with a predictive maintenance programme. By fitting a compressor with a range of sensor devices, which are connected to a remote monitoring system operated by the compressor OEM, the system can monitor the compressor around the clock and can use the data to predict when maintenance is required or when a part may be under stress and could fail.

In comparison to using reaction-based breakdown maintenance, organisations can easily reach savings of up to 30-40% through the use of predictive maintenance.

Next generation Connectivity Platform

iConn is a flexible platform enabling extended data analytics and pattern recognition algorithms leveraging CompAir‘s application know-how.

Maintenance Checklist

As well as choosing the right type of maintenance schedule to suit the operation, plant managers should also ensure that their service provider is incorporating the following checks into its maintenance routines.

Firstly, filter elements should be changed at least once a year to help reduce pressure drops, meaning that the compressor will consume less energy to supply the required air pressure. In addition, poorly filtered intake air can raise the compressor’s internal temperatures which will have the effect of increasing the overall power consumption.

In oil-lubricated machines it is also essential to carry out regular oil changes, with the appropriate grade of oil to ensure machine longevity and reliability.

Regular checks for air leaks should also be carried out. As air is non-hazardous, leaks in the pipework will not affect process safety and can often go undetected. However, any leak in the network means that energy is being wasted, sometimes by as much as 20% – put simply, the compressor has to work harder to produce the required air pressure at the point of use.

A simple leak detection survey can identify any problems quickly, with remedial action undertaken at little cost.

Size Matters

Determining the right size of compressor for an application is an important consideration; especially as the capital cost of buying it is just a small part of the overall equation. What matters most is what it will cost to run the compressor over its whole operational lifetime.

Operating at a higher pressure than is necessary or with a poorly designed, leaky system will use more energy than required and lead to higher running costs.

One of the simplest ways to achieve this is to carry out an air audit that will identify potential and current compressed air demands and assess energy usage.

Where there is an existing compressed air system the site can be monitored over a fixed period of time to gather quantifiable data via a data-logging unit attached on each compressor in the network.

The results enable real time data to be analysed to ensure the selection of the most energy-efficient compressors. This will include the size and mixture of fixed and variable-speed compressors. The audit may also determine if a multiple compressor installation requires better control via a dedicated management control system.

Replacement Parts – A Genuine Concern

Operators should carefully consider their spare parts supply. Choosing non-genuine or third party spares can have a negative impact on compressor efficiency and energy consumption.

Non-genuine spares and lubricants are generally a cheaper alternative to the manufacturer’s original parts and, when cost is an issue, can appear to be a sound investment.

However, as well as a shorter operational life and the associated issues of compressor downtime, the wrong spare part can in some cases, cause real damage to the compressor, ultimately meaning the machine can fail completely. This won’t just result in an expensive repair bill, but will affect productivity with unscheduled machine downtime.

Replacement Is Necessary

Any compressor, whether brand new or one that has been performing well for many years will, in the normal course of operation, require components to be periodically replaced. These can include items such as filters, valves, seals and oil.

Unless a genuine, like-for-like replacement part is used, there can be no guarantee that the original performance will be maintained. Non-genuine parts are not manufactured to the same specification as the manufacturers’ original. By virtue of the fact that they are engineered to cost less, they will typically incorporate inferior components that cannot offer the same levels of energy efficiency or performance reliability.

In contrast, genuine parts have been manufactured to meet the same standards as the compressor they are intended for. This means that they have passed the same stringent manufacturers’ testing regimes, in a quality-controlled environment, to offer the repeatable, dependable operation that plant manager’s need to keep production costs down..

For further information please visit: http://rastgar-co.com/iconn/

By: Imtiaz Rastgar, Chairman and CEO of Rastgar & Co., Published in Monthly #Automark magazine August-2018 printed edition.