Dewan Farooque Motors Limited (DFML) which has applied for the revival of its car assembly plant and requested for grant of Brownfield Investment under Auto Development Policy for the production of LCV and Sangyang (SUV’s) vehicles has received “Brown Field” category status under Auto Policy 2016-21.

Automark confirmed from sources that DFML had received the approval letter from Ministry of Industry after fulfill the all required conditions by today.

Brownfield category which is basically for the revival of an existing assembly manufacturing facilities, that is non-operational or closed on or before July 01, 2013.

Earlier, there was some confusion / reservation of Engineering Development Board about the total period of closure of the DFML assembly plant. The matter was put on the 24th meeting of the Auto Industry Development Committee (AIDC). The committee held a detailed discussion on the application of DFML and unanimously approved the grant of Brownfield status to DFML. But Engineering Development Board refused to implement this approval on the pretext that this approval can be effective only after the suitable amendment in the auto policy but presently no change is possible since it is mentioned in the policy that it can be revised after two years while it is only in its first year of implementation. Resultantly all activities at DFML plant was suspended.

Ministry of Industries awarded Brownfield investment status to Dewan Farooque Motors Limited

Automark Magazine November 2017

<iframe style=”width:400px; height:300px;” src=”//e.issuu.com/embed.html#2035645/56739742″ frameborder=”0″ allowfullscreen></iframe>

Hyundai coming to Pakistan, but not so soon!

Recently Hyundai has made a lot headlines, everyone is waiting for them to release their vehicles. Our country from a long time has received car models from the typical three Japanese manufacturers (Toyota, Honda and Suzuki) they have been dominating automotive industry in the country from decades and this just might be changing soon, but not as soon as everyone is expecting it to.

It is true many companies have tied up with investors to open up in Pakistan including Kia, Renault Hyundai and few other Chinese, but till now most progress has been seen to be made by Hyundai. However the production is not to start as soon as people think.

Hyundai with a ground breaking ceremony opened up a vehicle assembly plant in Faisalabad, the joint of Hyundai Nishat Motors project costs around 230$ Million. The plant will initially produce 7000 vehicles in 2020 and is expected to reach up to production of 30,000 vehicles by 2030. From confirm sources Automark got news that right now Hyundai Nishat Motors does not have any feasible way to import vehicles in CBU condition due to RD into the Pakistan, locally assemble vehicles may sales are expected to start in or before 2020.

With increasing hype to new companies coming into Pakistan, other companies are also getting interested into investing for the new ventures. Millat Tractors Limited has recently shown interest for buying stakes in the Hyundai Nishat Motors joint venture. ‘The board of directors’ of the company has approved their request and Millat Tractors Limited can now invest up to 18% in the company.

Renault and Brilliance ink JV to make LCVs in China under three brands

The venture, Renault-Brilliance-Jinbei Automotive Co, will have manufacturing operations in Shenyang, the provincial capital of Liaoning

Groupe Renault and Brilliance China Automotive Holdings Limited (Brilliance) have confirmed signing a contract for the formation of a joint venture to manufacture and sell light commercial vehicles (LCV) under the Jinbei, Renault and Huasong brands with the goal of achieving 150,000 sales annually by 2022 and an acceleration of electrifying powertrains.

The new JV will be known as Renault-Brilliance-Jinbei Automotive Co with manufacturing operations in the Dadong District of Shenyang and will locally produce three key segments — MPVs, medium vans and heavy vans. The Chinese LCV market is reaching upwards of 3 million units annually.

To form the JV, Groupe Renault is purchasing a 49 percent equity interest in Shenyang Brilliance Jinbei Automobile Co (SBJ). SBJ is being restructured into a JV owned 51 percent by Brilliance China and 49 percent by Groupe Renault. The companies had signed a framework cooperation agreement to pursue the formation of the joint venture in July of this year. Thierry Aubry has been named CEO of the JV. Aubry’s background includes retail, manufacturing and distribution experience in China and France.

“Groupe Renault has been investing and expanding in China for four years now with joint ventures focused on passenger cars, commercial vehicles and electric vehicles. The Renault-Nissan-Mitsubishi Alliance gives us access to a wide array of technologies, with more than 50 billion euros in R&D investment over the next six years, part of which will enable Renault-Brilliance-Jinbei Automotive Company to develop products tailored to the Chinese market. We see China not only as the biggest car market worldwide, but also as a trend setter for the auto industry,” said Carlos Ghosn, chairman and CEO of Groupe Renault.

Groupe Renault is part of the world’s largest automotive group with its Alliance including Nissan and Mitsubishi. Brilliance has made significant investment in the Jinbei brand, which has been the No.1 bus brand in China for more than a decade with an expertise in entry-cost MPVs and with leading market share in medium vans at 31 percent.

“Brilliance and Groupe Renault are joining hands to build a world-class model for the development of LCVs. It will change the map of the Chinese and even global LCV market. Both companies will build the joint venture into a world-renowned leader in three areas— commercial vehicles, new energy commercial vehicles and customized commercial vehicles. This win-win partnership will create huge economic and social benefits, accelerating the development of automotive industry in Liaoning Province and China,” said Qi Yumin, chairman of Brilliance Automotive Group Holdings Company Limited.

Leveraging of complementary strengths

The JV provides a platform for the partners to bring complementary strengths together with Brilliance delivering an existing dealer network of 220, project engineering capability and manufacturing capacity. As demand in China increases for Europe-style vans and LCVs that meet higher safety, emissions and energy-efficiency standards, Renault brings expertise in new technologies, core engineering capability and business management expertise. The JV’s first focus will be to invigorate the Jinbei brand and then to manufacture Renault LCVs in China by 2020.

Groupe Renault, which celebrates its 120-year anniversary in 2018, has been making LCVs since 1900. The company is a global LCV leader that has a full line-up of vans and pick-ups with 10 LCV models including four EVs.

Honda Atlas Car’s low profile campaign on deadly Takata Air Bag

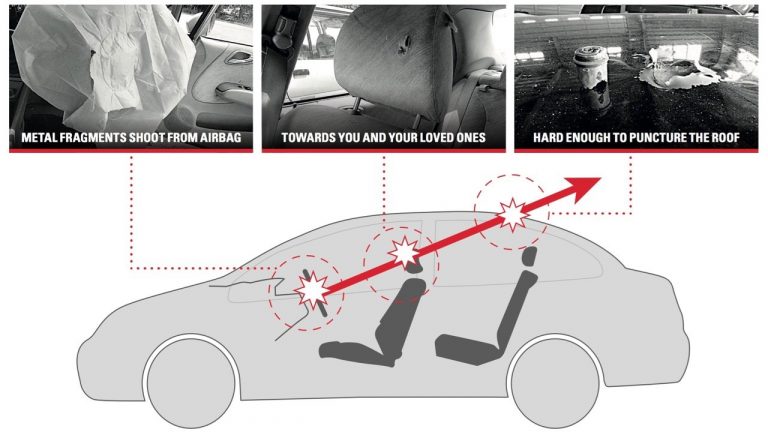

As part of Honda’s Global Takata Airbag inflator campaign during airbag deployment, the company said — airbag inflator body may explode into metal fragments due to excessive internal pressure

PAMA comes to rescue Honda Atlas on low quality petrol issue, while other assemblers face no problem

Honda Atlas Cars Limited (HACL) has initiated a half-hearted campaign informing owners of Honda Civic users/owners about installation of faulty Takata Air Bag and its impact on human lives. As per past practice nobody in the company was allowed to further give details to the press.

In March and April 2017, the company, instead of directly highlighting repercussion of Takata air bag, kicked off the serious issue in a non serious manner under the big headline “Free Upgrade of Vehicles” in the print media advertisement informing the customers that “in Honda Civic (2006 to 2012 model), imported CRV 2008 to 2011 model and imported Honda Accord 2004 to 2012 model – SRS inflator pump may have a possibility of malfunction. Vehicle owners were asked to contact authorized dealers immediately.”

The consumers saw the banner headline “Free Upgrade of Vehicles” and ignored the contents below the main headline. Due to lukewarm response from the vehicle owners, the company in middle of October 2017 again stepped up its earlier campaign with new name “Honda Special Service Campaign. Your Safety Is Our Top Priority” with more details to showcase the worse-case scenario in a vehicle that has yet to have its Takata airbag inflator replaced. The second campaign had also not focused on the main issue “faulty air bag” prominently.

As part of Honda’s Global Takata Airbag inflator campaign during airbag deployment, the company said — airbag inflator body may explode into metal fragments due to excessive internal pressure. Inflator rupture may result in metal fragments striking and potentially injuring the vehicle occupants.

The company, instead of giving priority to the risk factor of faulty air bag on the left passenger and driver, took the airbag issue very lightly in its media campaign fearing adverse impact on the sale of Honda Civic. The company had deliberately attempted to give secondary importance to air bag issue which on the contrary had hit headlines in world media over huge vehicles’ recalls plunging Takata air bag maker in deep crisis and bankruptcy.

The recall of locally assembled Honda Civic 2006 to 2012 model for replacing faulty Takata air bags will cost Honda Cars of Japan which is taking claims from Takata Air Bag. Honda Atlas will not feel the pinch of bearing the cost of replacing air bag which runs into billions of rupees.

Honda dealers gave different estimates about the cost of air bag. Some said the cost of two bags were around Rs 90,000-100,000 while others estimate close to Rs 200,000. Some said over 40,000 Honda Civic models had Takata defected air bags while others estimated about 22,000 vehicles.

Taking the price range of Rs 90,000-100,000 of air bags being reinstalled in 40,000 vehicles would cost Rs 3.6 billion to Rs four billion. If the volumes are estimated at 22,000 and price of Rs 90,000-100,000 then the cost of air bag would come to 1.9 billion to Rs 2.2 billion.

It is not clear as to how much the local assembler of Honda cars has completed air bag related replacement work from March till to date. Dealers did not give any clear reply when asked whether the company is installing a different brand of air bags.

Dealers claimed the arrival of vehicle owners is higher than previous campaign. “The company is offering free new installation of two air bags (driver and passenger side inflator).

As per figures of Pakistan Automotive Manufacturers Association (PAMA), the production of Honda Civic from 2005-2006 to 2012-2013 has crossed 50,000 units. Honda Civic 2006-2012 models must have changed hands with multiple owners over the years, but the local dealers said the company is offering the installation of new bags to everybody who own Civic right now.

“We have the list of chassis number of affected vehicles. After tallying it we offer free installation either in just few hours or one day time,” dealers said.

Prior to HACL — Indus Motor Company (IMC) had recalled 9,896 Toyota Corolla vehicles in February 2017 owing to faulty brakes and 2,700 Corolla models in June 2017 after finding that the front mounting bolts of the front seats may be improperly tightened.

Despite these two recall alerts — the sales and revenue figures of Honda Atlas remained brisk so far despite air bag recall, while the call to recall 12,000 vehicles by IMC had also so far not affected the sales.

Now HACL has been struggling to overcome low quality fuel issue and Takata Air bag. The company has advance booking of five months for Honda Civic. The production figures from November onwards will give the exact picture of any negative impact on the company’s financial health over two issues.

Sales revenue of Honda Atlas for the first quarter ended June 30, 2017 almost doubled, to Rs 21,058.1 million against Rs 10,533.3 million in the same period of last year, mainly due to increase in unit sales and better product mix. The company earned profit after tax of Rs 2,086.3 million against Rs 1,050.7mn, up 98pc over first quarter of last year.

Net sales revenue of Honda Atlas for the financial year ended March 31, 2017 improved to Rs 62,802.7mn against Rs 40,085.5mn of last year. The profit after tax improved to a record Rs 6,135.0mn against Rs 3,555.8mn, up by 72.5pc.

Rai Umar Basharat at Top Line Securities said during 2QMY18, Honda Cars reported earning of Rs1.6bn (EPS: Rs 11.3) up 10 per cent YoY (-22 per cent QoQ). In 2QMY18, the company’s net sales grew 48 per cent YoY on account of strong volumetric growth in sales volumes during the period, with Honda City (lower priced car) capturing more of the sales mix. The company sold 2,070 BRV units in outgoing quarter, while total unit sales of 12,604 were up 56 per cent YoY.

Although sales were up 48 per cent, gross profits rose by 9 per cent only as gross margins shrunk 4.3ppts to 11.8 per cent vs. 16.2 per cent last year. Margin decreased due to higher portion of low margin variants (BRV and City). While rising steel prices (CRC prices up 33 per cent during the period) also added to costs.

In 2QMY18, other operating income increased 116 per cent YoY, due to increased costumer advances backed by healthy bookings for the City and BRV, he said.

During 1HMY18, the company reported earnings of Rs3.7 billion (EPS Rs25.9), up 47 per cent YoY. Net sales have grown 69 per cent YoY driven by sales of 23,642 unit up 56 per cent YoY. However margins declined from 16 per cent to 13 per cent due higher costs and higher sales of low margin variants.

In world market, a new report on recalls of potentially deadly Takata air bag inflators shows that automakers have replaced only 43 per cent of the faulty parts even though recalls have been under way for more than 15 years.

The report, issued by an independent monitor who is keeping tabs on the recalls, also shows that auto companies are only about halfway toward a December 31 goal of 100 per cent replacement of older and more dangerous inflators.

The slow completion rate comes even though the National Highway Traffic Safety Administration began coordinating the recalls and phasing them in two years ago. Before that, the automakers were obtaining parts and distributing them on their own. Normally automakers fix 75 percent of vehicles within 18 months after the recall is announced.

The report brought criticism from a U.S. senator in Florida, whose state has seen three deaths caused by the problem and where automakers have fixed 41.7 percent of the 3 million affected inflators.

Takata uses the chemical ammonium nitrate to create a small explosion and fill air bags quickly in a crash. But the chemical can deteriorate when exposed to high humidity and temperatures and burn too fast, blowing apart a metal canister designed to contain the explosion. That can hurl hot shrapnel into unsuspecting drivers and passengers. At least 19 people have been killed worldwide and more than 180 injured.

The problem touched off the largest series of automotive recalls in U.S. history, with 19 car and truck makers having to recall up to 69 million inflators in 42 million vehicles. It also brought a criminal conviction and fine against Takata and forced the Japanese company into bankruptcy protection.

The automakers, he writes, are using different communications methods to reach owners such as door-to-door canvassing. They also are offering mobile repair and trying to use third parties such as independent repair facilities to speed up the process.

As per foreign media reports, Honda is also recalling about 800,000 of its Odyssey minivans in the United States over faulty parts blamed for 46 minor injuries, the company said, just a month after settling a huge lawsuit on other defects.

The recall, which affects the 2011-2017 models sold in the U.S., may later be expanded to include vehicles sold in Canada, Mexico and South Korea. The fault relates to a latch that connects the back seat..

If not properly engaged, the seat may tip forwards during braking, a statement said, adding the firm “has received 46 reports of minor injuries related to this issue.”

The announcement comes after the Japanese group last month reached a $605 million settlement in a lawsuit over defective airbags in millions of cars on American roads.

Honda joined Nissan, Toyota, BMW, Mazda and Subaru in agreeing a deal that also included replacing the defective airbags from now-bankrupt Japanese car parts maker Takata, and compensating car owners.

On low quality petrol issue raised by Honda Atlas – the strict policy of management does not allow any officials to reveal anything to the press. Hardly any print media has seen any interview or reports in which senior executives, owners or any lower rank Honda employees are quoted neither on petrol or other issues.

Honda Atlas informed the Oil and Gas Regulatory Authority (OGRA) in October on the issue of low quality fuel relating to high manganese contents resulting in production halt of Civic Turbo model due to engine knocking problems and damaging of catalyticconverter.

After rocking the entire auto sector and even refinery and retail pumps operators – the officials of Honda Atlas have stopped issuing any further update on the low quality fuel and even the management and senior officials have also been ignoring the media queries over further development on the issue.

However, Pakistan Automotive Manufacturers Association (PAMA) has proved that it is a strong arm working under influence of the makers of Honda bikes and cars. PAMA has come out to the rescue of Honda Atlas saying that “all the assemblers are facing serious technical issues due to low quality of fuel,” thus creating a rift among assemblers. PAMA has asked the regulator to check the metal contents (including manganese) in the petrol being marketed against the international standards as assemblers are facing serious technical issues due to low quality of the fuel.

On the issue of manganese content in petrol, PAMA informed the regulator that addition of manganese is meant to boost the Research Octane Number (RON) of the fuel in the process of achieving a targeted number. There are hazardous technological and environmental repercussions of the metal content in the fuel if used beyond certain safe limit. From the technical stand point, it would impair engine performance in the long run may choke the catalytic converter thus aggravating pollution level by not blocking/converting the unsafe substances of the exhaust which are hazardous to human health, PAMA said.

In contrast, CEO of Indus Motor Company Ali Asghar Jamali in a print media report had said “we have not received yet any serious complaints with respect to our Toyota vehicles regarding low quality petrol.” So far Pak Suzuki Motor Company Limited has not got any complaint of engine knocking or other sort of issues from the customers on petrol quality issues.

Chairman All Pakistan Motor Dealers Association (APMDA), H.M. Shahzad said used cars of three years old models are being imported from Japan and these vehicles have latest engines which are being used by the leading manufacturers.

“So far no owner of used cars has complained about engine knocking or other problems after using petrol of various oil marketing companies,” he claimed.

Oil Companies Advisory Council (OCAC) claims that the refineries and OMCs are supplying petrol according to the government’s specifications.

OCAC Chairman Aftab Husain said “we have checked and found that there is no abnormality of high manganese content in petrol,” adding that in Pakistan there is no government cap on manganese in petrol.

“If the Euro II petrol is the specification how come EURO IV designed engine will meet the requirement,” he asked.

He said recently the government has improved the specification of petrol and 92 RON has taken over 87 RON. Higher quality petrol (95 and 97 octane petrol) is also available for consumers’ choice.

Honda Atlas has so far not come out with any reply to the threat given by OCAC which strongly urged Honda to withdraw its complaint about the alleged sale of low-quality fuel in the market or face legal action.

This exclusive article published in Monthly AutoMark Magazine’s printed edition of December-2017

Toyota Vios to be launched in Pakistan by 2018

With anticipation rising about the expected launch of 2018 Toyota Vios in Pakistan, the petrol heads are eagerly awaiting any information about this exciting new vehicle. Vios is a family sedan by Toyota, which the companyplans to launch in Pakistan in 2018. Toyota has been a famous car brand in the automotive market of Pakistan with some well-established nameplates already ruling the hearts of car enthusiasts. Toyota Vios is available in the car markets of Malaysia, Philippines, India and others where it is one of the most sought-after Toyota Vehicles. The launch of Toyota Vios can prove to be a big breakthrough for the famous car brand as it will fall in the segment of the midsize semi-luxury sedan and give a tough competition to the likes of Honda City and Suzuki Ciaz.

Let’s review the all-new Toyota Vios and have a look at its features, specification and technologies in detail:

Design Language of the 2018 Toyota Vios

The design language of Toyota Vios is based on a sharp and elegant design complemented by contemporary sedan looks. The exterior of the sedan is welcoming and delightful while it’s interior and purposefully built to deliver an exceptional driving experience to the driver and passengers.

Exterior

The sharp and stunning exterior of Toyota Vios can give an adrenaline rush to the onlookers when the vehicle is one the move and even when it is standing still.It boasts a long and distinctive hood that depicts sheer style and class. A recognizable front grille blends in with the bright and wide Xenon headlights while the Toyota badge at the center is the highlight of the exterior. The edges and fine lines flow throughout the bodyand make the Toyota Vios a true delight for car enthusiasts.

The carefully crafted curves define the design language of the Vios. It looks sleek and stylish from the front-endand the rear end of the vehicle demonstrates excellencewith state-of-the-art taillights and fog lamps. Toyota Vios is available in the worldwide car markets in 12 different exterior colors. These colors are Freedom White, White Pearl, Gray Metallic, Black, Red Mica Metallic, Blue Mica Metallic, Orange Metallic, Dark Brown Mica Metallic, Alumina Jade Metallic, Blackish Red Mica and Thermalyte.

Interior

The interior of the Toyota Vios is laced with a wide variety of modern day amenities for maximum comfort and convenience of the occupants of the car. The interior is spacious and can easily accommodate 5 passengers which makes it a true family sedan. There are a plenty of entertainment options available for ultimate fun and high-qualityleather seatsjust take the comfort of the Vios to an entirely different level. Some of the delightful in-cabin features of the Toyota Vios include a 7-inch display screen with touch interface, 4 speakers and Bluetooth connectivity. There is also a MirrorLink System that allows you to transfer the media from your phone to the touchscreen of the car for enhanced fun and pleasure.

Engine Options

Toyota Vios features the segment’s finest engine lineup with a variety of engine options available that can be selected as per the choice of buyers. The four engine variants that are available in theglobal car markets are 1.3 Base, 1.3 J, 1.3 E and 1.5 G. However, Toyota Vios is expected to be launched in Pakistan in just one engine option. It will be a 1.3-Litre DOHC 16 Valve engine with Dual VVT-I technology. It will produce 98 horsepower and a torque of 123Nm. The highlight of all the engine variants of Toyota Vios is their fuel efficiency. The 1.3-Litre engine variant is expected to deliver a fuel average of 14-16 Km/L.

Safety Features and Driver-Assistance Systems

There are plenty of safety features and driver-assistance technologies that make the Toyota Vios a safe vehicle to travel. It takes care of the safety of passengers which augments the family car appeal of the vehicle.

Listed below are the safety features and driver-assistance technologies available in the all-new Toyota Vios:

• 6 Airbags for Driver and Passengers

• Cruise Control

• Brake Assist

• Anti-lock Braking System with Electronic Brake Distribution

These advanced car safety technologies help to avoid a dangerous road accident and can also provide protection from fatal injuries in event of an accident.

Price and Launch Date of Toyota Vios in Pakistan

The Indus Motors, which is the official distributor of Toyota vehicles in Pakistan hasn’t announced any launch date for Toyota Vios yet but it is expected to hit the car markets in December 2018 as per the speculations going around. The expected price of Toyota Vios in Pakistan is PK 1,750,000.

by Syed Sarim Raza for Automark Magazine printed edition of December-2017

Chinese truck maker rides electric boom

FAW Jiefang Automotive Co. Ltd., an established Chinese truck manufacturer, has opened its first production base for electric trucks.

The base in the eastern coastal city of Qingdao is expected to produce 50,000 full electric trucks each year, according to the company, a subsidiary of China’s leading auto maker FAW Group.

The company has developed light, medium and heavy new energy trucks, said Hu Hanjie, general manager of FAW Jiefang.

New energy vehicles, including all-electric and plug-in hybrid vehicles, have seen explosive growth in China.

Statistics from the Ministry of Industry and Information Technology showed that 517,000 new energy vehicles, including full electric vehicles and plug-in hybrids, were manufactured and 490,000 were sold between January and October, both up more than 45 percent year on year.

Since the first Jiefang truck was manufactured in 1956, the brand has sold more than 6.6 million trucks and exported to 80 countries and regions.

In 2016, the company sold 202,000 trucks, 185,000 of which were medium and heavy vehicles, holding the biggest market share in China at 19.25 percent. Its output this year has exceeded 300,000, the company announced Thursday.

In addition to the electric push, Jiefang will also focus on research for self-driving trucks in coming years.

China FAW, Dongfeng Automobile and Changan auto sign strategic cooperation agreement

China’s FAW, Dongfeng Motor and Changan automobile have opened a new chapter of cooperation, which helps Chinese auto companies to seize the strategic commanding heights and help Chinese car brands to become louder, stronger and better

China’s FAW Group, Dongfeng Motor and Chongqing Changan Automobile at the end of last week signed a broad based collaboration agreement aimed at improving efficiency, sharing costs and targeting future growth

Three major central enterprises in the domestic automotive industry (FAW, Dongfeng and Changan) signed the strategic cooperation framework agreement. The three party will cooperate in the field of forward-looking technology innovation, full value chain operation, going out and new business mode.

China First Automobile Group Corporation (hereinafter referred to as the “China FAW”), Dongfeng Motor Group Co. Ltd. (hereinafter referred to as “Dongfeng Automobile”), Chongqing Changan automobile Limited by Share Ltd (hereinafter referred to as the “Changan car”) strategic cooperation framework agreement signing ceremony was held in Hubei, Wuhan.

According to the agreement, the three parties will be in prospective, generic technology innovation automotive value chain operation, combined to “go out” and new business models such as the four areas to carry out all-round cooperation, which marks the Chinese automobile industry “national team” to start the comprehensive cooperation, work together to promote the development of the auto market and Chinese Chinese car brand comprehensive strength.

China First Automobile Group Corporation chairman, party secretary Xu Liuping, China South Industries Group Corporation party secretary, chairman Xu Ping, Dongfeng Motor Group Co., Ltd. chairman, general manager, deputy secretary of the Party committee, deputy party secretary Li Shaozhu, deputy general manager of China South Industries Group Corporation, Chongqing Changan automobile Limited by Share Ltd chairman Zhang Baolin, China First Automobile Group Corporation, Dong Chunbo, Wang Guoqiang, Qin Huanming Qiu Xiandong, Dongfeng Motor Group Co., Cheng Daoran, Liu Weidong Wen Shuzhong, An Tiecheng, Chongqing, Changan automobile Limited by Share Ltd Steve Chow, Yuan Mingxue, Li Wei, Hua Dubiao attended the signing ceremony. Qin Huanming, Liu Weidong and Steve Chow signed the agreement on behalf of the three parties.

Four major areas in depth cooperation to create a new situation of win-win development. According to the strategic cooperation agreement, the first in the field of innovation forward common technology, set up three car enterprises will actively participate in the intelligent network of automobile national innovation center, Changan FAW, Dongfeng Automobile and automobile China co founded “prospective generic technology innovation center”. The three parties around the new energy, intelligence, network and light fields of strategic core technology platform for joint investment, development, and sharing technology.

secondly, in the field of vehicle full value chain operation, the three party will focus on strengthening the coordination of traditional vehicle platform and powertrain and other aspects, in the field of production and cooperation, and collaborative procurement, and deepen cooperation in the field of logistics.

Addition, in expanding overseas markets, the three parties will actively implement the national “The Belt and Road” initiative, to explore the depth of cooperation in overseas products, overseas terminal, cyber source overseas business partners, overseas manufacturing resources, international logistics etc..

All party will also explore new business models together, and strengthen the forward-looking research and cooperation of vehicle sharing, travel services and new eco environment of the automotive industry. We will explore synergy in the financial field and jointly plan for participating in smart city and intelligent transportation construction.

Practice the national strategy to promote the construction of automobile power

The nineteen report of put forward that we should speed up the construction of manufacturing power, accelerate the development of advanced manufacturing industry, cultivate world-class advanced manufacturing clusters, and create a world-class competitive enterprise with global competitiveness. This has provided an important follow for the construction of automobile enterprises and the bugle of the new era of China’s auto industry.

China FAW, Dongfeng Automobile and Changan automobile shoulder the important mission of building a powerful automotive country, and have strong demand for bigger and bigger businesses. Strengthening strategic interaction, deepening strategic cooperation, realizing the win-win development of vehicle enterprises and promoting the construction of auto power are three wishes of the vehicle companies, and the concrete actions to implement the nineteen spirit of the party.

After nearly twenty years of rapid development, the quality and competitiveness of Chinese automobile products has been greatly improved, and began to compete with foreign brands in a positive way. The rapid development of mobile Internet spawned cross-border integration, industrial integration of new ecology, the automobile industry is undergoing profound changes, the electric, intelligent, network sharing, lightweight, has become the new development direction of automobile industry chain. China’s FAW, Dongfeng Motor and Changan automobile have opened a new chapter of cooperation, which helps Chinese auto companies to seize the strategic commanding heights and help Chinese car brands to become louder, stronger and better.

To promote technological innovation, optimize the whole value chain operation, expand overseas market and explore new business models, is the most important vehicle development in the future, and also the key to accelerate the development of Chinese auto enterprises. China three car companies to deepen cooperation is necessary and timely to conform to the trend of economic globalization and market integration, optimize the industrial layout, with the development of advanced manufacturing industry policy is a new exploration of the implementation of “automobile industry long-term development plan”.

tedt

test