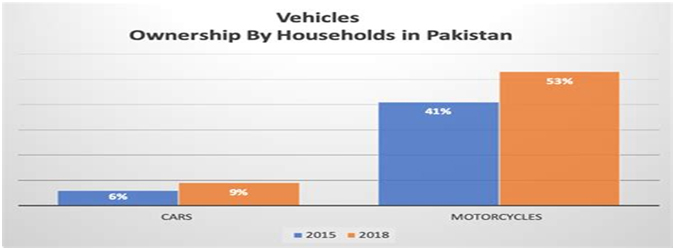

Dear Readers Pakistan, with its strategic location, rising population, and emerging logistics needs, presents a unique opportunity in the commercial vehicle sector. While private automotive markets—especially motorcycles and small cars—have seen rapid expansion, the commercial vehicle industry remains relatively stagnant. A combination of fragmented planning, policy loopholes, and strategic missteps from key local players has left a significant vacuum in this market.

This article explores the current approximate size of Pakistan’s commercial vehicle market, a breakdown of different segments including LCVs, pickups, heavy-duty trucks, vans, MPVs, and luxury buses, and uncovers why the vacuum exists—mainly due to misaligned priorities and underinvestment by major local entities.

1. Market Size and Overview

Pakistan’s commercial vehicle market has not kept pace with the country’s logistics and infrastructure demands. With road freight still accounting for more than 92% of goods transport in Pakistan, the demand for commercial vehicles—especially LCVs and heavy trucks—should ideally be higher than current numbers suggest.

Estimated Annual Sales by Segment (approximate figures based on industry insights and market trends up to 2024):

| Segment | Annual Units Sold (2023) | Comments |

| LCVs (Light Commercial Vehicles) – Pickups (0.5 – 2 tons) | 20,000–25,000 units | Dominated by Suzuki Ravi, Toyota Hilux |

| Medium Pickups / 3-ton Trucks | 4,000–6,000 units | Fragmented; some Chinese imports |

| Heavy-Duty Pickups / 5-ton | 3,000–4,000 units | Primarily for industrial use |

| Heavy Trucks (above 6 tons) | 5,000–6,500 units | Increasing demand with CPEC/logistics |

| Vans / MPVs | 12,000–15,000 units | Used for passenger/family + school |

| Luxury Buses (Intercity + Executive) | 1,500–2,500 units | Mostly import-based, high-margin segment |

Total Market Size (2023): 50,000 to 60,000 units/year

Despite a sizable freight and passenger demand, these numbers reflect underutilization of potential, especially in freight vehicles and intercity buses.

2. Key Players and Brands

Local OEMs / Assembling Players:

- Ghandhara Industries (Isuzu trucks and buses)

- Master Motors (Foton, Changan, Yutong)

- Hinopak (Hino trucks & buses – facing decline)

- Suzuki Pakistan (Ravi, Bolan – LCV segment)

- Toyota Indus Motors (Hilux – premium pickup)

Import Players (Used/New):

- Chinese brands like Dongfeng, JAC, FAW

- Japanese imports (used buses, MPVs)

- European players in luxury segment (Volvo, Mercedes)

Many of these brands are under-marketed, poorly positioned, or neglected due to a shift in business focus or financial constraints.

3. Segment-Wise Insights

a. LCVs & Small Pickups (0.5 – 2 Ton)

This is the most active segment due to its use in small logistics, agriculture, and urban goods transport. The Suzuki Ravi dominates due to price point, though it’s outdated and lacks features.

Growth Potential: Huge. A modern alternative with better payload, safety, and efficiency could disrupt this space.

b. 3-Ton and 5-Ton Trucks

Historically served by Hino and Isuzu, this segment is now underserved. With industrial logistics growing (e.g., e-commerce, FMCG, pharma), demand for efficient mid-size trucks is increasing.

Challenge: Lack of product innovation, dealer networks, and financing options.

c. Heavy-Duty Trucks (6–30 Ton)

Demand is largely project-driven: CPEC, highways, ports, and fuel tankers. Players like Isuzu and Foton have attempted to serve it, but limited financing and low aftersales coverage slow adoption.

Opportunity: Leasing-backed sales model and fleet programs could unlock growth.

d. Vans / MPVs

Used by schools, tour operators, and families (especially in northern areas), MPVs like Suzuki APV, Toyota Hiace, and Changan Karvaan have steady demand.

Growth Driver: Tourism resurgence, rural mobility needs.

e. Luxury & Intercity Buses

A niche yet highly profitable market. Mostly served by Yutong and Higer (through Master Motors), these buses are used in premium intercity services like Daewoo, Faisal Movers, Road Master, etc.

Missed Potential: No local bus manufacturing plant has captured the premium market fully.

4. The Vacuum: Why the Market Isn’t Thriving

Despite economic and logistical potential, the market lags. The key reasons include:

a. Lack of Strategic Focus by Local Players

Some major players, particularly those with strong history in truck/bus manufacturing (like Hinopak), have failed to innovate or adapt. They have also diverted resources to other segments or haven’t invested in R&D.

b. Shift to Passenger Vehicles

Local assemblers and investors have prioritized passenger cars, MPVs, or SUVs due to:

- Easier financing

- Consumer-driven demand

- Higher margins per unit

- Lower regulatory complexity

This has left the commercial sector in a state of under-service.

c. Poor Government Policy / High Duties

- High import duties on CKD and CBU units

- Lack of tax benefits for fleet modernization

- No scrappage policy for old commercial vehicles

These discourage investment in new commercial vehicle lines.

d. Financing Bottlenecks

- Most commercial vehicles are bought cash-down

- Financing options are rare outside Tier-1 cities

- No government-backed fleet-leasing programs

This reduces sales penetration, especially in heavy segments.

5. Benefits of Filling the Vacuum

If stakeholders take action, the payoff could be significant:

a. Economic Multiplier Effect

More commercial vehicles = faster goods movement = better supply chains. This fuels growth in:

- Agriculture

- Retail/FMCG

- Manufacturing

- E-commerce logistics

b. Employment Generation

Every new truck/bus supports 2–3 direct jobs (drivers, mechanics) and dozens indirectly (logistics companies, suppliers).

c. Export Opportunity

With right scale and focus, Pakistan could export commercial vehicles to:

- Afghanistan

- Central Asia

- East Africa

- Smaller Gulf states

d. Environmental Modernization

Upgrading to Euro-IV/V compliant fleets can drastically reduce emissions. Government support can make Pakistan a green transport leader in South Asia.

6. What Needs to Change?

To unlock the potential, key reforms and actions are needed:

| Stakeholder | Required Action |

| Local OEMs | Invest in R&D, launch modern commercial models, create fleet-leasing programs |

| Government | Reduce duties, incentivize local assembly, offer commercial vehicle financing schemes |

| Banks & NBFCs | Launch tailored CV loan products, especially for SMEs and logistics startups |

| Investors | Reassess commercial sector profitability vs saturated car markets |

| International Partners | Encourage CKD partnerships with Chinese and Japanese commercial brands |

The commercial vehicle sector in Pakistan stands at a critical juncture. While demand for logistics and mobility continues to rise, the supply side—especially for trucks, LCVs, and buses—remains underdeveloped due to poor planning, diverted corporate focus, and policy neglect.

This vacuum is not just a gap—it’s an opportunity waiting to be seized by forward-looking automakers, logistics firms, and policymakers. With the right alignment of vision and investment, Pakistan could transform its transport landscape and unlock billions in economic value.

This exclusive article has been written by @Aqeel Bashir, and published in Automark’s May-2025 printed/digital edition.