The constant evolution of technology promises an even more connected future, and understanding your car is more than just learning about its parts and functions, it’s all about developing a deeper connection with the machine that takes you on countless adventures.

By embracing the silicon symphony and the world of resources available, you become an empowered driver, ensuring a safe, enjoyable, and long-lasting relationship with your car, on the other side the constant evolution of technology presents both challenges and opportunities. From self-driving cars to smart grids, automation is streamlining processes and optimizing resource utilization. Imagine traffic lights that adjust to real-time conditions or factories that operate with minimal human intervention, leading to increased efficiency and productivity.So, fasten your seat belts and prepare to be amazed at the rise of electronic control systems induction in the modern vehicles that are being designed and used.

Let us understand the scope of Silicon Symphony which has been getting started and is constantly evolving, with it spromise to rewrite the entire score of automotive technology, this network of electronic components is revolutionizing the way cars operate, pushing the boundaries of performance, safety, and comfort. Modern vehicles have witnessed a dramatic integration of electronic control systems, often referred to as the electronic revolution or the silicon revolution. These electronic systems have fundamentally transformed the way cars operate, influencing nearly every aspect of performance, safety, and comfort. The Silicon Symphony isn’t just about speed, it’s about keeping you safe. Advanced electronic systems like ABS and traction control act as your guardian angels on the road, preventing accidents and giving you more control. systems like automatic climate control and infotainment systems create a personalized driving experience, making every journey a pleasure cruise.

The Future of the Silicon Symphony: The Silicon Symphony is constantly evolving, and with new technologies emerging all the time, The term Silicon Symphony refers to the intricate network of electronic components that orchestrate the operation of modern vehicles. The conductor of the symphony, the ECU is the central brain of the engine, interpreting sensor data and sending signals to control functions like fuel injection, ignition timing, and emissions. Here you can say that Sensors are the eyes and ears of the engine, constantly monitoring various parameters like air intake temperature, engine speed, and exhaust gas.

Actuators are the muscles that translate the ECU’s commands into action. They can be components like fuel injectors, spark plugs, or throttle valves. A communication Network is a complex network of wires and buses that allows all these components to communicate with each other, ensuring smooth and coordinated operation.

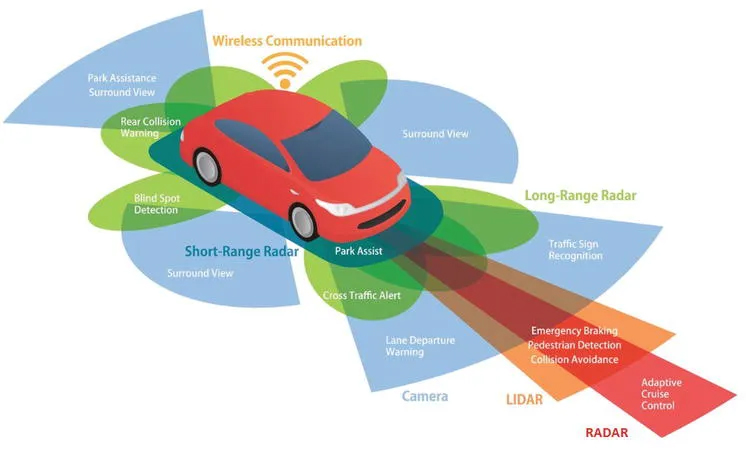

(i) Autonomous Vehicles: Self-driving cars depend on heavily on advanced sensors, powerful processors, and complex algorithms to navigate roads safely. Imagine a world where cars navigate roads with the precision of a maestro. Advanced sensors, powerful processors, and complex algorithms are making autonomous vehicles a reality.

Autonomous vehicles, also known as self-driving cars, are vehicles that can sense their environment and navigate without human input. They use a variety of technologies, including radar, lidar, cameras, and GPS, to perceive their surroundings and make decisions about how to move. There are many potential benefits to autonomous vehicles. They could make roads safer by reducing the number of accidents caused by human error. They could also make transportation more accessible to people who cannot drive themselves, such as the elderly or the disabled. Additionally, autonomous vehicles could help to reduce traffic congestion by optimizing traffic flow. However, there are also some challenges associated with autonomous vehicles. One challenge is the development of reliable sensors and software that can accurately perceive the environment in all conditions. Another challenge is the legal and regulatory framework for autonomous vehicles. It is important to determine who is liable in the event of an accident involving an autonomous vehicle.

(ii) Vehicle-to-Everything (V2X) Communication: Cars will be able to communicate with each other and with infrastructure, creating a more connected and efficient transportation system. The future of transportation is about communication. Vehicle-to-everything (V2X) technology will allow cars to talk to each other and infrastructure, creating a safer and more efficient traffic flow.V2X communication represents a significant leap forward in creating a safer, more efficient, and more connected transportation ecosystem. As V2X technology continues to evolve and gain wider adoption, we can look forward to a future where the roads become a network of intelligent vehicles, all speaking the same language for a smoother, safer journey for everyone. V2X allows vehicles to exchange data with various entities in their environment, creating a more connected and intelligent transportation system.

(iii) Electric Vehicles (EVs): The rise of EVs presents a unique opportunity for even more sophisticated electronic control systems to manage battery performance and optimize electric drivetrains. The rise of electric vehicles presents a unique opportunity for even more sophisticated electronic control systems. Get ready to experience a whole new level of performance and efficiency as electronics orchestrate the power of electric drivetrains. Electric vehicles (EVs) are revolutionizing the way we drive. They are powered by electricity from batteries instead of gasoline or diesel fuel. This means they produce zero tailpipe emissions, making them a cleaner and more environmentally friendly transportation option. EVs use electric motors to propel the vehicle. The electric motor gets its power from a large battery pack that is typically located under the floor of the car. The battery can be charged by plugging the car into a charging station. There are two main types of charging stations. The future of EVs is bright. As battery technology continues to improve and the charging infrastructure expands, EVs are expected to become a more mainstream transportation option. EVs have the potential to significantly reduce greenhouse gas emissions and improve air quality. They can also help to reduce our reliance on foreign oil.

The Benefits of the Silicon Symphony: The rise of electronics in vehicles has brought about numerous advantages, The Silicon Symphony represents a significant leap forward in the automotive industry. It’s a testament to the power of electronics, not just in enhancing performance, but in creating a safer, more comfortable, and ultimately, more enjoyable driving experience. As technology continues to advance, the future of the Silicon Symphony promises an even more remarkable performance, orchestrated to perfection.

(a) Improved Performance: Electronic control allows for more precise engine tuning, optimizing power delivery and fuel efficiency, the Silicon Symphony’s impact on performance translates to a more responsive, powerful, and efficient driving experience. Modern turbochargers are electronically controlled, allowing for a “boost on demand.” This means the ECU can adjust boost pressure based on real-time driving needs. Imagine needing a burst of power for overtaking – the ECU can temporarily increase boost for a thrilling acceleration without compromising overall efficiency. The Silicon Symphony’s impact on performance is multifaceted. It allows for precise control, dynamic adjustments, integration with advanced features, and driver customization, all leading to a more exhilarating, efficient, and personalized driving experience.

(b) Enhanced Safety: Electronic systems like ABS (Anti-lock Braking System) and traction control give drivers greater control and prevent accidents. ABS is a testament to the power of electronics in enhancing safety. It’s a crucial component of the modern vehicle’s “Silicon Symphony,” working seamlessly to give you more control and prevent accidents on the road. Remember, ABS is there to assist you, but safe driving habits are always the first line of defense. Without ABS, a locked wheel can cause the car to skid and lose control. ABS maintains traction and stability, preventing the car from swerving or spinning out of control.

(c) Advanced Driver Assistance Systems (ADAS): Features like lane departure warning, blind spot monitoring, and adaptive cruise control utilize sensors and electronic control to enhance safety and driver comfort. Advanced Driver Assistance Systems (ADAS) are a suite of electronic technologies designed to improve safety, comfort, and convenience for drivers. These systems utilize a combination of sensors, cameras, radars, and software to perceive the environment around the vehicle and provide assistance or warnings to the driver. ADAS represents a significant leap forward in driver assistance technology.

It’s a crucial part of the modern car’s “Silicon Symphony,” working to create a safer, more convenient, and ultimately, more enjoyable driving experience for everyone on the road. Comfort and Convenience: Electronic systems power features like automatic climate control, power windows, and infotainment systems, making the driving experience more enjoyable.

(d) Diagnostics and Maintenance: Electronic systems provide valuable diagnostic data, making it easier to identify and address potential problems with the vehicle, the integration of electronics has transformed diagnostics and maintenance from a reactive process to a more proactive and preventative approach. This ensures your car stays in top shape, potentially saving you money and extending its lifespan. So, the next time you hear your engine purr, remember the silent symphony of electronics working tirelessly in the background, keeping your vehicle healthy and yours. Future vehicles might boast even more sophisticated self-diagnostic capabilities. Imagine your car not only alerting you to potential issues but also recommending corrective actions, empowering you to take better care of your machine, Electronic systems can continuously monitor the health of critical components like batteries or brake pads. This allows for proactive replacement before they fail unexpectedly. No more forgetting oil changes or tire rotations! Many vehicles come with electronic service reminder systems that keep you on top of your car’s maintenance schedule.

Modern vehicles are a complex symphony of electronic components, working in perfect synchronization to deliver exciting performance, unparalleled safety features, and an ever-increasing level of pleasure and comfort. This intricate network of electronic systems can be aptly described as a Silicon Symphony. Modern vehicles are a far cry from the sputtering, purely mechanical machines of the past. They have become complicated systems, indeed, where a complex symphony of electronic components work together to deliver an experience that’s not just about getting from point A to B, but about a complete solution and the ability to diagnose and fix the issues with the supporting gadgets.

Takeaway from this article:

Traditionally, many vehicle functions relied on mechanical components and systems. The modern approach utilizes electronic control units (ECUs) that receive sensor data, interpret it, and send precise electronic signals to various components like fuel injectors, spark plugs, and throttle valves. This allows for much finer control and optimization compared to mechanical systems. The Silicon Symphony represents a significant advancement in the automotive industry. It has led to vehicles that are not only more powerful and efficient but also safer, more comfortable, and packed with features that enhance the driving experience. The Silicon Symphony represents not just a technological revolution but a paradigm shift in the automotive industry.

As vehicles become more connected, intelligent, and performance-oriented, they cease to be mere modes of transportation and evolve into dynamic platforms for innovation and expression. From enhancing safety and efficiency to redefining the concept of mobility itself, the possibilities unlocked by the Silicon Symphony are as vast as the imagination. The Silicon Symphony represents a remarkable transformation in the automotive industry. By harnessing the power of electronics, car manufacturers are creating vehicles that are not only more powerful and efficient but also safer, more comfortable, and even capable of driving themselves. As technology continues to advance, the future of the Silicon Symphony promises even more innovation and exciting possibilities for the way we travel.

Exclusive written for Automark Magazine, May 2024

By Muhammad Rafique, Head of Production and Maintenance

Foton JW Auto Park (Pvt.) Limited

This exclusive article has been published in Automark Magazine – International, May-2024 printed edition from Pakistan.

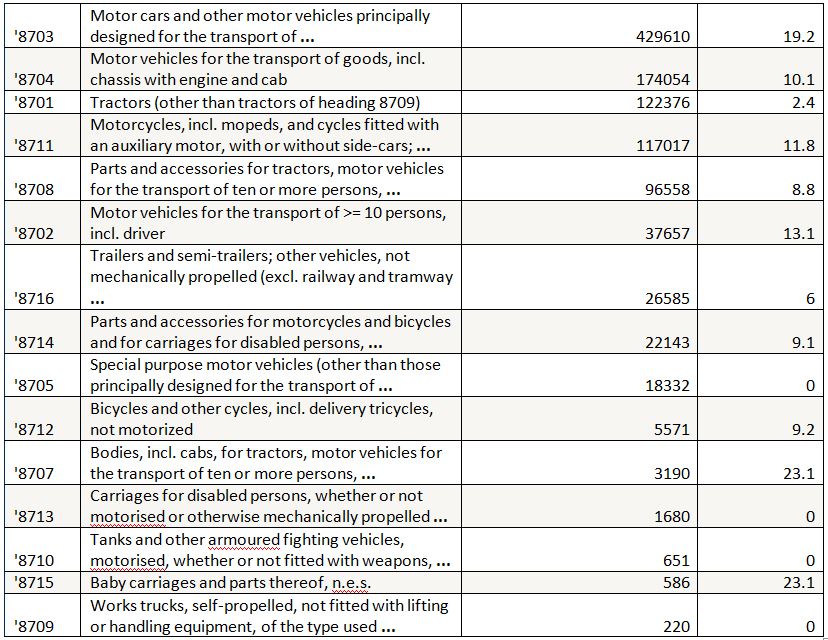

Key Economic Indicators: