Dear Readers! Having spent 23 remarkable years navigating the intricate landscape of Pakistan’s automotive industry, I’ve witnessed its evolution firsthand. From nascent assembly lines to today’s more diverse, albeit still challenging, market, one profound truth has consistently guided my perspective and, I believe, holds the ultimate key to sustainable success: The Customer as Our North Star.

In my early years, the industry often felt like a monologue. Products were conceived globally, localized minimally, and then presented to a customer base with limited options. After-sales service, while present, often felt like a necessary chore rather than a relationship-building opportunity. The focus, naturally, gravitated towards production targets, import efficiencies, and distribution logistics. However, over two decades, the Pakistani customer has matured. They are more informed, thanks to digital access; more demanding, given increased choices; and more discerning, as their aspirations rise. This shift fundamentally altered the game, slowly but surely transforming how successful automotive players operate.

In the competitive and fast-moving automotive industry of today, where product innovation, localization, and a strong dealer network are the drivers of success, there is one single principle that is that the customer has to be the absolute first point of contact in all areas of our business. This is not a department or a slogan, but a basic philosophy that must be embedded in every decision, strategy, and interaction of our automotive company. Historically, companies may have been operating from a product-push mindset: “We make great cars, and people will buy them.” Today’s smart, well-informed customers expect more. They expect solutions, experiences, and relationships. To take a “customer-first” stance requires a fundamental change of thinking throughout the entire organization, from product pushing to knowing and meeting customer needs at every touch point. It requires a deep-seated cultural change, commitment to knowing customer needs at every level, and an unhealthy fixation on delivering outstanding value and experiences.

By putting the customer at the center of all that we do, we don’t merely build cars; we build long-term relationships and a successful, sustainable business. This attitude turns companies from product-pushers into trusted partners and that’s what drives growth, loyalty, and competitiveness. Putting the customer first in every area of your operations means that every process and team is aligned to what the customer desires and values, Putting the customer first in every area of your operations is an expression of a deep alignment in an organization where every team, process, and decision is consciously aimed at knowing, anticipating, and fulfilling the needs, wants, and values of the customer. It’s about building a business where the customer is not just a transaction, but the driving force behind all that you do, in reality, getting everyone and everything aligned to what the customer needs and values means building an organization that breathes and lives for its customers. It’s about delivering a seamless, positive, and valuable experience at every touch point, building loyalty, and ultimately driving sustainable business success. It requires conscious and consistent effort, driven by leadership and embraced by every single employee. Customer satisfaction is embedded in your KPIs which mean embedding customer satisfaction in your Key Performance Indicators (KPIs) means making a commitment of substance to measuring and managing your business on how well you’re doing on customer needs and expectations.

It changes customer satisfaction from a desirable outcome to a core driver of performance and decision-making across the organization. The company listens to, learns from, and acts on customer needs consistently is making it crystal clear that “The company listens to, learns from, and acts on customer needs consistently” is describing a deeply customer-centric organization that has embedded feedback and responsiveness into its operational DNA. It’s more than just listening to customer opinions and involves a never-ending cycle of understanding, adaptation, and improvement. Here’s a breakdown of what it means: a company that actually listens, learns, and acts on customer needs consistently places the customer firmly at the very center of its operations. A never-ending cycle of feedback, analysis, and action drives a customer-centric culture and ultimately drives greater success.

The Holistic Approach: Customer-First as the Guiding Principle: By embedding this customer-first philosophy into every process and group, an automotive company in Pakistan can do more than simply sell cars to build long-term relationships, build unprecedented brand loyalty, and assure a sustainable, profitable future in a value-hungry and trust-hungry market. Ultimately, the success of our automotive business in Pakistan depends on embracing a holistic, customer-first approach. When we are talking about placing the customer first in every facet of your operations means that every process and group is deliberately aligned with what the customer wants and values.

In the Pakistani automotive market, this is not only best practice, but a strategic imperative to manage the unique challenges and unlock the immense potential of this market. By placing the customer at the center of our product development, localization initiatives, dealer network operations, and aftersales service, we can consistently exceed customer expectations, build trust, and establish a loyal customer base. A customer-first approach is the key to long-term, sustainable growth and profitability. Also, satisfied customers are likely to recommend our products and services, generating increased sales and market share. as we are well aware, in a competitive marketplace, a reputation for exceptional customer focus can be a powerful differentiator.

In the highly competitive and fast-changing automotive ecosystem of Pakistan, the old business model, which tended to focus on production quotas or short-term sales targets, is generally obsolete. Today, the long-term success of any automotive business is based on a single, unflinching principle: the customer must be the absolute first point of contact in every single aspect of our operations. Treating the customer as an afterthought, or as a simple endpoint in our value chain, is not merely a strategic error; it’s a direct recipe for stagnation and eventual collapse. This philosophy is especially important in Pakistan, a market defined by distinctive consumer requirements, changing economic conditions, and a history of difficult customer experiences.

An integrated, customer-first strategy is the only means of generating loyalty, sustainable growth, and effectively localizing. For automotive companies in Pakistan, the “customer-first” strategy is not a theoretical construct; it’s a survival and prosperity imperative. It requires a holistic, unflinching commitment to product development, localization, dealer network strategy, and after-sales service. By profoundly understanding, consistently serving, and continuously exceeding the expectations of the Pakistani customer, businesses can create invaluable loyalty, differentiate themselves in a crowded market, and create a truly resilient and future-proof automotive business.

Any compromise on this fundamental principle is, in fact, a recipe for stagnation and eventual collapse. Our product development, localization activities, dealer network strategy, and after-sales service are all essential areas that must be thought up, executed, and continuously optimized with an unflinching focus on understanding and exceeding customer needs and expectations. Treating the customer as an afterthought or as a simple endpoint in our value chain is a recipe for stagnation and eventual collapse.

The journey starts with the product itself. Our engineering and design teams need to delve deep into the aspirations, pain points, and desires of our target customer segments. This entails extensive research to determine the unmet needs, emerging trends, and changing preferences in the Pakistani market. This extends beyond fundamental demographics to consider lifestyle, usage patterns, and affordability factors. Extremely important to incorporate feedback and input from the potential customers in the design and development process through surveys, focus groups, and feedback sessions. This way, our products are absolutely synchronized with their needs and desires. Ensuring our products provide an attractive value proposition, balancing features, quality, and price point in a manner that appeals to the target market.

Our dealership network is the initial and most critical point of contact for our customers. Their experience must be seamless, informative, and positive, and we must enable our dealership staff with extensive product knowledge, world-class customer service skills, and customer rapport building abilities. Ensuring our dealerships act responsibly and transparently in all their interactions, sales or service. Locating dealerships in strategic locations to facilitate access to our target customer segment throughout Pakistan. Designing dealerships that are welcoming, comfortable, and provide customers with all the information they require making an informed decision. Our customer focus extends far beyond the point of purchase.

Excellent after-sales service is crucial in building long-term relationships and fostering brand loyalty. Building strong customer support mechanisms and actively seeking customer feedback to identify areas of improvement and address concerns in a timely manner. Offering a range of value-added services, such as extended warranties, roadside assistance, and convenient service arrangements, to enhance ownership experience.

Takeaway from this article:

If we make the customer our guiding star, our North Star which informs every decision and action, we can create a sustainable and long-lasting presence of automobiles in Pakistan. It starts and ends with understanding and serving our customers’ needs. In the competitive and dynamic environment of today’s automobile industry, the customer must be at the heart of everything: every decision, strategy, and process. From design and dealership experience to aftersales service and online interaction, everything needs to be informed by customer expectations and satisfaction. Putting the customer at the center of everything as a starting point of approach builds trust, propels loyalty, and generates long-term value. It aligns quality, service, innovation, and convenience with what matters most to the individuals we serve. Such a method not only increases operations performance but also brand reputation and business sustainability. Finally, placing the customer as our North Star drives excellence, not only in sales, but in creating meaningful, long-term relationships that drive growth and innovation in the auto industry.

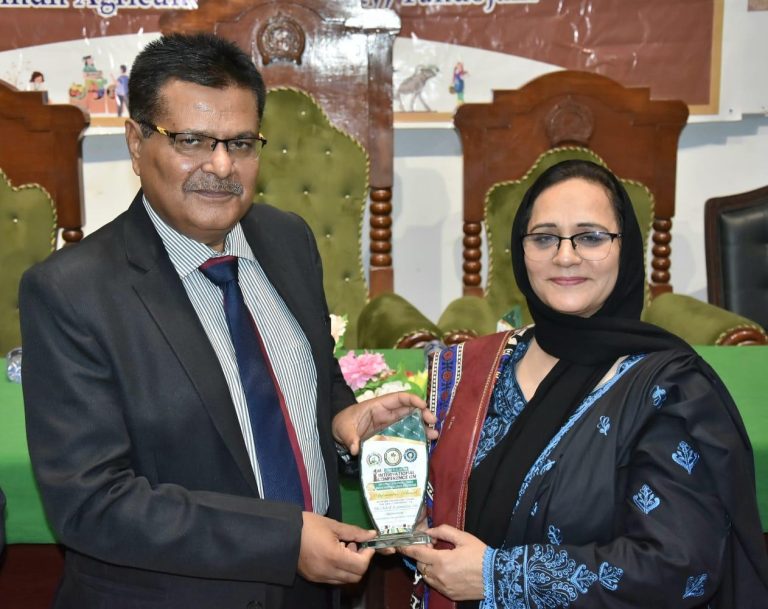

This exclusive article has been published in Automark Magazine’s June-2025 printed and digital edition. Written by @muhammad-rafique