Suzuki Mehran may live another life

It seems that after all Suzuki Mehran, despite the announcement of discontinuation by Pak Suzuki Motor Company (PSMC) in 2019, may have another life at a new plant set up in Lahore by a leading Chinese two-wheeler assembler.

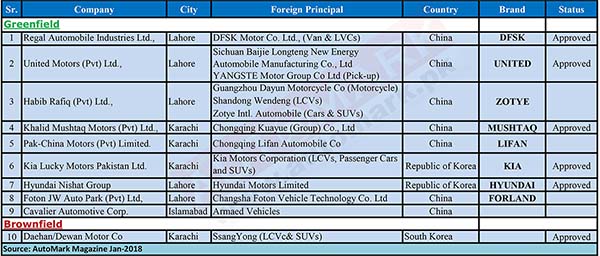

In June 2017, the Government, under the Automotive Development Plant (ADP) gave permission to United Motors, KIA-Lucky Motors and Nishat-Hyundai to setup green field plants in Pakistan. These new entrants were given special incentives by way of reduced customs duties on import of CKD kit for local assembly of their vehicles.

United Motors (Pvt) Limited

United Motors (Pvt) Ltd., number one bike assembler of Chinese bikes, has entered into local assembly of vehicles that are look-alike of Suzuki Mehran and Ravi but with minor design variations to avoid copyright litigation.

The plant of United in Lahore is ready to produce Mehran and Ravi lookalikes in first half of 2018. It means that the company, instead of introducing its new models in CBU form, has taken a risk to start assembly of 800cc vehicles.

It also means that the company has procured CKD parts from its Chinese Principal and also from local vendors. Commercial production will begin next year just three months before Suzuki Mehran is expected to be discontinued by PSMC. United Auto Industries is venturing into car and pickup manufacturing, United Motors General Manager Sales and Marketing Muhammad Afzal told leading English daily.

United has already run advertisement saying that United Motorcycle is now entering into car manufacturing industry for which dealers are required for the company’s new endeavors. The company has sought application for dealership network latest by December 2017.

He said the company will use Chinese technology (Sichuan Baijie Longteng New Energy Automobile Manufacturing Company and YANGSTE Motor Group Co Limited (pick up) and market its vehicles under the brand name of United. “The local assembly of these vehicles will begin in the first half of 2018,” he added.

The market is abuzz with reports that United is bringing out Chinese cars in collaboration with leading Chinese vehicle assembler – Changan. “Our car and pickup are not the copy of Suzuki brands. Our vehicles are totally different and loaded with various attractive features and safety standards,” Mr Afzal said.

As for the pricing, he said the company intends to keep it “very affordable”. The official did not give any details about the company’s investment in the greenfield project, level of localisation, plant capacity and monthly production number. Pak Suzuki Motor Company is watching the situation from the sidelines. The company has not reacted yet over the plant set up by United Group where Mehran like car will come on the assembly line shortly.

Since 1987, Suzuki Mehran has been the car of choice for customers that have wanted to upgrade from motorcycles to their first automobile. Mehran’s reliability as a first car, its affordable price, low cost parts and extensive after sales network has attracted the middle class which cannot afford to buy more expensive local or imported vehicles.

This might be a story similar to arrival of Chinese motorcycles in 2005 onwards that were look-alikes with Honda’s best selling CD-70 but with a 40 per cent lower price. The customers flocked to embrace these Chinese 2-wheelers, which now dominated with 50-60 per cent market share.

Interestingly, despite the low cost Chinese option, Honda still sells around 700,000 CD-70 motorcycles. When faced with the Chinese threat, it increased localization in CD-70 and reduced the price by Rs 10,000 to bring down the difference and compete with the Chinese products. That strategy has worked out well for Atlas Honda as it is still the largest seller of motorcycles in the country.

Pak Suzuki’s strategy might be different. It plans to discontinue Mehran and introduce the next generation Alto in March 2019. Sources say that Alto will come with better quality and features but with a price tag of Rs 850,000-Rs 900,000 for the basic variant.

It is also being said that United is planning to launch the Mehran look alike at a price of Rs 500,000-Rs 550,000 and will follow it up with look-alikes of Bolan and Ravi. Market reports say that the price of new Chinese 800cc vehicle would close to Suzuki Mehran price like Rs 600,000-700,000.

Mehran, Ravi and Bolan, as an 800cc category, are the largest segment in the auto industry. Combined, these three vehicles sell approximately 8,000 vehicles per month. So far, Pak Suzuki has dominated this sector since another new entrant Al-Haj FAW’s pickups and vans are around Rs 100,000 more expensive than Pak Suzuki Ravi and Bolan respectively.

It is yet to be seen if United car, with a price level lower than Suzuki Mehran would be able to make a dent in Pak Suzuki’s market share, especially during the remaining period of Mehran’s ouster and when Japanese 800cc will be out of the market. The future seems to be full of excitement in the auto industry, with the consumers waiting for affordable options of vehicles especially in the small vehicle category.

Some nine players belonging to bike and property business will try to cash their luck in car and LCV segment. To tap the booming auto sales and demand – some players are fighting legal battle claiming to hold the first right of ownership. In around nine strong competitors in Greenfield projects – seven Pakistani stakeholders have collaborated with Chinese auto sector while two have ventured to introduce Korean automobiles.

Khalid Mushtaq Motors Private Limited.

One is Khalid Mushtaq Motors Private Limited which recently received a green signal from the Ministry of Industries and Production (MoIP) to set up a vehicle assembly and manufacturing unit in Nooriabad industrial area under the Greenfield investment category.

KMML Chief Executive Anwar Iqbal said the company has signed a technical collaboration agreement with the Chinese company KYC, a part of Changhan Group, for assembling light commercial vehicles and mini passenger vans.

“We will market the vehicles with the brand name of Mushtaq,” he said, adding that the total investment of the project is around Rs1 billion which would create 200 direct jobs.

The company has planned to assemble vehicles from second quarter next year. The plant has the capacity to roll out 100 vehicles per month.

He said the auto industry is blossoming and the China-Pakistan Economic Corridor will also open new avenues for the growing automobiles industry.

According to the industries ministry, the local partner will strictly adhere to the conditions laid down in the notifications.

The company would enter into an agreement with the ministry to ensure compliance to the conditions and various timelines for completion of the project for availing incentives under the Auto Development Policy 2016.

The Engineering Development Board (EDB) shall issue manufacturing certificate and list of importable components to new investors after it verifies that the assembly facilities established by the company are adequate to produce roadworthy vehicles.

Pak China Motors Private Limited.

Pak China Motors Private Limited has yet to get environmental clearance from Environmental Protection Agency due to which the company had closed down their business activities. An official said that the company has revived its plan to resume its activities.

Foton JW Auto Park Private Limited.

Foton JW Auto Park Private Limited (owner of Haier Appliances) has collaborated with Changsha Foton Vehicles Technology of China. However, a legal war is going on between the owner of Haier Appliances and Master Motors Private Limited while company already had groundbreaking of auto assembly plant adjusted to Haier Factory at Riwind road in Lahore.

Master Motors has taken JW Auto to the court claiming ownership right of Foreland trucks. In response, owner of Haier has approached to its principals in China seeking original document or agreement reached between Master and Chinese manufacturer.

As the legal fight lingers on – import of Foreland trucks is going on and the trucks are available at dealership network.

Regal Automobile Industries Limited.

Regal Automobile Industries Limited, whose project has been approved by the government and according to Sources Company already, had all the required documents and permission from government including investment agreement.

They have set up an assembling unit at Multan Road Lahore to produce van and LCVs under DFSK Motor Company Limited of China. However, Pirani Group claims to have already secured a contract with DFSK which is (most probably) expiring in 2017. It is not known what the strategy of Pirani Group is whether it will approach DFSK again or let Regal Automobile to continue with Chinese company.

Habib Rafiq Private Limited.

Habib Rafiq Private Limited is planning to assemble cars, LCVs and SUVs in collaboration with Shandong Wendeng and Zotye International Automobile.

The government has so far not approved the plan of the company but they have submitted all require documents to concern department for approvals.

Cavalier Automotive Corporation

Islamabad based Cavalier Automotive Corporation is in talks with Armaed Vehicles of China.

Two projects involving Korean auto giant are progressing fast.

Hyundai Nishat Motor Private Limited.

Prime Minister Shahid Khaqan Abbasi has performed ground breaking of Hyundai Nishat Group project in Faisalabad for the assembly of cars and LCVs. The local production of vehicles expected to begin within two years.

The Plant is joint venture between Nishat Group 60% and Sojitz corporation 40% Japan total project costs around 230$ Million while a TLA and Distributor agreement with Hyundai Motors Korea. Millat may take 18% of Nishat share.

The plant will initially produce 7000 vehicles in 2020 and is expected to reach up to production of 30,000 vehicles by 2030.

Hyundai Nishat Motor Ltd signed an investment agreement with the Ministry of Industries and Production under the Automotive Development Policy 2016-21 earlier this week to set up a Greenfield project to undertake assembly and sale of passenger and one-tone commercial vehicles.

The company, as per sources, will not import vehicles in CBU form due to imposition of heavy regulatory

duty. Hyundai’s return to Pakistan will boost the government’s efforts to shake up the Japanese-dominated car market and loosen the grip of Toyota, Honda and Suzuki, who assemble cars in Pakistan with local partners.

Hyundai and South Korea’s Kia Motor used to assemble cars in Pakistan until 2004 but withdrew after their local partner Dewan Farooque Motors Limited plunged into financial difficulties.

KIA Lucky Motors Pakistan Limited.

South Korean carmaker KIA Motor Co will start assembling cars in a joint venture with Karachi-listed Lucky Cement, part of the vast conglomerate Yunus Brothers Group.

According to company sources, they already sing investment agreement, had all required environmental clearance from Environmental Protection Agency and done groundbreaking ceremony in November-2017 during a simple ceremony at Port Qasim area in Karachi. Now they in process of establishing assembly plant while other had working for importing cars in CBU units for local market.

Groupe Renault and Al-Futtaim

Local media ran a lot of reports saying European car assemblers also eye Pakistan to launch local assembly but so far French auto maker had dared to take the risk.

After suspending talks with Ghandhara Nissan Limited (GNL), French automaker Renault is making another attempt to assemble and distribute its vehicles in Pakistan in partnership with Al Futtaim, a Gulf-based business house.

Groupe Renault and Al-Futtaim have signed definitive agreements to assemble vehicles in a new plant in Karachi. The transaction remains subject to a number of conditions mainly relating to regulatory approvals.

The two parties expect that the plant will be built starting the first quarter of 2018. Car sales will begin in 2019 and be ramped up in 2020.

It is surprising that the agreement was not signed in Karachi where the plant will be built. The companies did not reveal the amount of expected investment. They did not state the number of vehicles that the plant will roll out every year.

Al Futtaim said it will “invest the amounts needed to make this project a great success, but as privately owned company, we do not reveal financial details.”

Renault suspended talks with GNL as per a notice that the former sent to the Pakistan Stock Exchange (PSX). GNL informed stock investors that the company, in collaboration with a potential partner, was in talks with Alliance (Renault-plus-Nissan).

However, owing to commercial reasons, GNL’s arrangements with the potential partner could not materialise. From then on, Nissan has been in discussion with GNL while Renault suspended talks, it said. “They, however, shared their view that Pakistan is an alliance project and they aim to select only one partner for Renault and Nissan models in Pakistan,” it added.

Sazgar Engineering Works Limited

Sazgar Engineering Works Ltd informed investors through the Pakistan Stock Exchange that it has signed a vehicle assembly cooperation agreement with a Chinese auto-maker for manu-facturing, assembling, sales and after-sales service of passenger and off-road vehicles. The company has not given any further details.

The auto policy 2016-2021 is now bearing fruits due to rising interest of Chinese and Korean vehicle manufacturers. Barring France’s Renault, European makers are cautiously taking their steps and none of them have shown any serious interest to set up assembly plant in Pakistan. However, limited imports of European cars like BMW, Audi, Mercedes, and Porsche etc have already been going on for many years.

At a time when big players in Europe, USA and China are focusing more introducing electric cars in years to come to reduce consumption of fossil fuels – the foreign players are bringing up their investment mainly in diesel and petrol engine vehicles to least developed countries like Pakistan.

There is a remote chance that the existing assemblers Japanese car giants like Toyota, Suzuki and Honda in Pakistan will ever make any effort to bring electric cars in the next five to 10 years.

Many countries including India have shown their determination and fixed targets to end usage of petrol and diesel and bring electric vehicles.

For Pakistan, China is the only real hope where electric cars are already in use in higher volumes. The price of electric vehicle in China must be quite cheap as compared to other competitors like Germany, Japan and Korea.

The government needs to take some initiative and encourage imports of electric car from China by fixing a reasonable duties and taxes on its imports. This will at least give a new experience for the Pakistani people to drive electric vehicles. In case the import volume soars on high demand – it will open a chance for the local assembly of Chinese electric vehicle. For electric vehicle success – the government needs to create an infrastructure.

Exclusive Reviewed by Awais Khan & Hanif Memon

Published in Monthly AutoMark Magazine’s January-2018 printed edition