Wishing all automotive professionals, enthusiasts, and Automark members a year 2025 marked with collaboration, resilience, and success as work to redefine the future of transportation. To innovation, progress, and drive the world forward—Happy New Year!

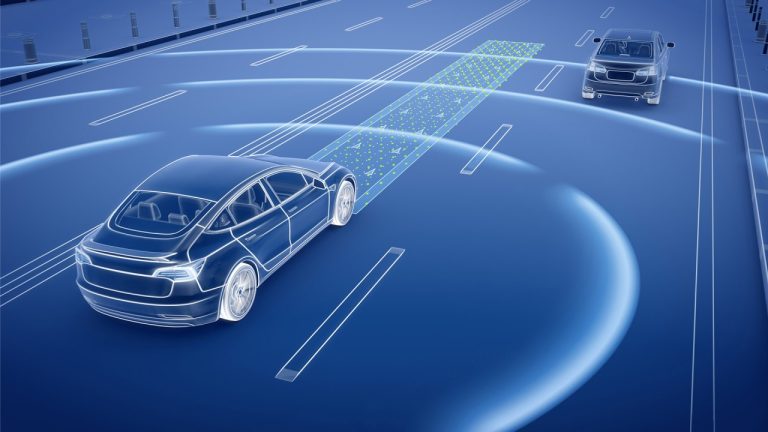

As we accelerate into 2025, the automotive industry stands at the forefront of transformative innovation and sustainable practices. The dawn of electric mobility, self-driving capabilities, and green manufacturing waits all in 2025.

The promise will be for a future of technology that walks hand-in-hand with environmental stewardship. Here’s to a transformative opportunity for the automotive industry’s visionary engineers, designers, and leaders whose efforts will shape the next generation of mobility. As we move ahead, let us embrace the principles of sustainability, innovation, and collaboration. We can achieve milestones that will redefine transportation and contribute to a cleaner, smarter, and more connected world. EV adoption is expected to rise with improved battery technology, expanded charging infrastructure, and government incentives.

Automakers will release more affordable, longer-range EVs to make electric mobility accessible. Autonomous vehicles in Level 4 and Level 5 will gain further ground in 2025, with pilot programs opening up to more urban settings. Advanced driver-assistance systems will become the norm, boosting safety and convenience. A strong focus on eco-friendly materials, energy-efficient manufacturing processes, and circular economy principles will also be strengthened. Carbon-neutrality goals will continue to challenge manufacturers to look for innovative ways to minimize emissions throughout the value chain.

The industry will also continue investing in upskilling and reskilling programs to prepare the workforce for advanced technologies and AI-driven systems. Acute collaboration with academia and training programs will ensure the next generation of automotive professionals will be prepared to lead transformation.

Let’s understand the key performance indicators critical to assessing performance, efficiency, and profitability of Aftersales Service operations in the automotive industry. A strong set of KPIs will help dealerships and service centers optimize processes, enhance customer satisfaction, and boost revenue. Monitoring and optimizing aftersales service KPIs is necessary for driving profitability, customer satisfaction, and long-term business success. Focusing on key metrics such as service retention, first-time fix rates, and workshop efficiency can turn after-sales operations into a reliable revenue stream for dealerships. A data-driven approach not only fosters loyalty but also ensures competitiveness in a rapidly evolving automotive industry.

In last month’s article on Service Absorption Rate (SAR), published in Automark Magazine, we explored the financial resilience of aftersales operations and its pivotal role in sustaining automotive dealerships. Earlier, the Fix It Right principle was highlighted as a cornerstone of operational excellence.

When these two concepts are interlinked, they form a robust strategy for ensuring profitability and customer satisfaction in the automotive aftersales segment, Service Absorption Rate (SAR) represents the percentage of a dealership’s fixed operating expenses covered by profits from aftersales services (service, parts, and accessories). A high SAR reflects a dealership’s ability to remain profitable even during fluctuations in vehicle sales. The intersection of Service Absorption Rate and Fix It Right principles demonstrates the power of embedding financial metrics with customer-centric practices. By striving toward operational efficiency and prioritizing customer satisfaction, dealerships can double their advantage: financial stability, and sustained customer loyalty.

As these concepts evolve, they will keep on being the benchmarks of excellence in the automotive after-sales industry, this month’s editions of Automark Magazine, let’s understand the Service Retention rate. The Service Retention Rate (SRR) is not just a metric. It is a reflection of how well a service center or dealership meets and exceeds customer expectations. By focusing on quality, transparency, and customer-centric initiatives, businesses can enhance retention rates, driving long-term profitability and customer loyalty. The Service Retention Rate is the percentage of customers who return to a dealership or service center for repeat maintenance or repair services after their initial visit. It is a critical performance indicator in the aftersales segment, reflecting customer loyalty, satisfaction, and the effectiveness of retention strategies.

The formula for the computation of the Service Retention Rate:

Service Retention Rate (%) = (Number of Returning Customers / Total Number of Customers) x 100

Returning Customers: Those customers who come for service or repair within a stipulated period.

Total Customers: All customers serviced during the same period

The Service Retention Rate (SRR) is one of the most potent metrics to determine the success and sustainability of aftersales operations in the automotive industry. Dealerships can achieve higher retention rates through quality, convenience, and customer-centric strategies. Thus, investment in SRR improvement is not just a matter of financial returns but also building long-term relationships that can help to develop trust and brand advocacy.

Factors that Affect Service Retention Rate: Several interrelated factors influence the Service Retention Rate (SRR), which is vital for keeping customers satisfied, loyal, and returning for regular service. By focusing on providing high-quality service, creating a positive customer experience, using technological progress, offering competitive pricing, and maintaining transparency and trust, automotive businesses can raise their SRR and keep customers for life. Ultimately, a high SRR contributes to profitability, customer loyalty, and a reputation in the long run in the automotive industry.

Quality of Service: A Pillar of High Service Retention Rates: The quality of service offered at a dealership or service center is one of the key factors that determine the Service Retention Rate (SRR). Good quality service ensures customers find trust in the provider for value and are incentivized to return for more when needs arise again. Below, read further into how the actuality of service quality drives retention rates and ways to build its potential. Experienced, manufacturer-certified technicians who can cover regular maintenance and perform detailed repairs. Training programs regarding newer technologies, like electrical cars and ADAS advanced driver-assistance systems. The Dealership / Repair workshop shall use only authentic, manufacturer-approved parts for the vehicle’s reliability and longevity.

First-Time Fix Rate: ensuring that repairs and maintenance are done correctly the first time. Quality checks and audits regularly to avoid errors. A good service quality directly determines the SRR as customers will come back trusting you, feeling loyal, and having a good experience at your workshop. By focusing on qualified technicians, authentic parts, timely delivery, and open communication, an automotive service center will have high retention rates and build long-term relationships with its customers. In a competitive market, service quality delivered is the key differentiator to drive immediate and long-term success.

Customer Experience: The Heart of Service Retention: Customer experience (CX) is one of the most important factors that drive the Service Retention Rate (SRR). It includes every interaction a customer has with the dealership or service center, from initial contact to the completion of service. A positive experience fosters trust, loyalty, and a willingness to return for future services. Providing detailed explanations of diagnostics, repair processes, and costs, meaning to say have clear communication with customers. Customer experience is not just about providing good service; it’s about creating memorable and seamless interactions that exceed expectations.

A positive experience builds trust, drives loyalty, and encourages repeat business, significantly boosting the Service Retention Rate (SRR). By focusing on convenience, transparency, personalization, and continuous improvement, service centers can ensure customers return time and time, making CX a cornerstone of aftersales success.

Pricing and Offers: The Value Proposition in Service Retention: Pricing and offers are essential factors that determine the SRR. Customers expect value for money in terms of quality service, and well-crafted promotional offers can persuade them to come back for future needs. The key is finding the right balance between competitive pricing and profitability to sustain loyalty and improve the overall after-sales experience. Prices must be benchmarked against the competition, including independent garages and third-party service providers.

Discounts or packages tailored to individual customer profiles, such as loyalty rewards or age-based discounts for older vehicles. Bundled maintenance packages (e.g., oil change, tire rotation, and inspection) at a discounted rate to encourage repeat visits. Running targeted offers during specific times of the year, such as pre-winter vehicle checks or summer road trip packages. Points-based systems in which customers collect rewards for return visits to be redeemed against future services or accessories. Pricing and offers are much more than a monetary incentive. They show the value of a service center to its customers.

Maintaining competitive, transparent pricing along with a good design in promotional strategies helps dealerships enhance customer loyalty and thus increase the SRR. This helps customers gain satisfaction while increasing long-term profitability and growth in the fiercely competitive market of automotive after-sales.

Technological Integration: Redefining Retention in Automotive Services: This is now a hallmark element in affecting the SRR for the automobile industry. Employing advanced technologies, systems, and processes improves efficiency and personalizes services while adding to the satisfaction of a customer; hence, a key aspect of retention. A detailed elaboration is given on how technological innovation affects SRR and what service centers can do for effective incorporation of innovations in the customer car business. Appointment booking via mobile apps, websites, or service portals is also provided at the client’s discretion. The technological assimilation into the automotive after-sales arena brings forth unprecedented possibilities to enhance SRRs.

By accepting digital tools and processes, service centers can provide outstanding customer experience, proactive maintenance, and solutions customized for a particular vehicle. While there are challenges, the strategic implementation of technology leads to long-term customer loyalty and sustained growth in the competitive automotive market.

Effect of Brand Perception on Service Retention Rate (SRR): A good brand reputation makes customers return for services instead of looking elsewhere. A good brand perception develops a relationship of trust between the customer and the service center. The chances of return service are higher if customers trust that the brand will provide reliable, transparent, and quality service. Brand perception is a vital element in shaping the Service Retention Rate (SRR).

A positive perception encourages customers to return, fosters loyalty, and ensures they choose the service center over competitors. Service providers need to focus on consistent quality, transparency, personalized experiences, and continuous engagement to build a strong brand that not only attracts new customers but also retains existing ones for the long term. In this way, automotive businesses can drive customer satisfaction, improve service retention, and ensure sustainable growth.

Takeaway from this article:

Service Retention Rate (SRR) is a critical metric for the long-term success and sustainability of any automotive business, particularly in aftersales service. A high SRR signifies that customers are satisfied with the service provided, trust the brand, and are likely to return for future needs. This, in turn, leads to increased profitability, stronger customer loyalty, and a competitive advantage in a crowded market. Other elements determining SRR are the level of service, customer satisfaction, technology, price, and perception of the brand.

Therefore, if superior services are offered in a very personalized way, at very competitive prices, and on more efficient technologies, the level of SRR for the automotive business can be greatly improved. In essence, service retention is not just about a repeat visit but also to build long-term relationships between the two parties involved built upon trust, transparency, and value. Businesses that work on enhancing their SRR can expect to have stronger customer loyalty, better word-of-mouth referrals, and a more stable revenue stream. Therefore, prioritizing SRR should be a key focus for any automotive service center looking to sustain growth and success in the ever-evolving market.