In July 2020, Pakistan motorcycle industry produced and sold the highest ever 300,000 units in a month, which was also appreciated by the Prime Minister’s advisors and ministers in the government’s cabinet.

In August 2020, the country recorded second highest sales of 240,000 units despite heavy rains all over the country and flooding in Karachi.

Contrary to this, the figures of Pakistan Automotive Manufacturers Association (PAMA) did not give a clear picture of production and sales due to limited numbers of its members.

As per PAMA data, a number of manufacturers witnessed revival in the sales from depressed sales during lockdown due to rising COVID-19 cases in the country.

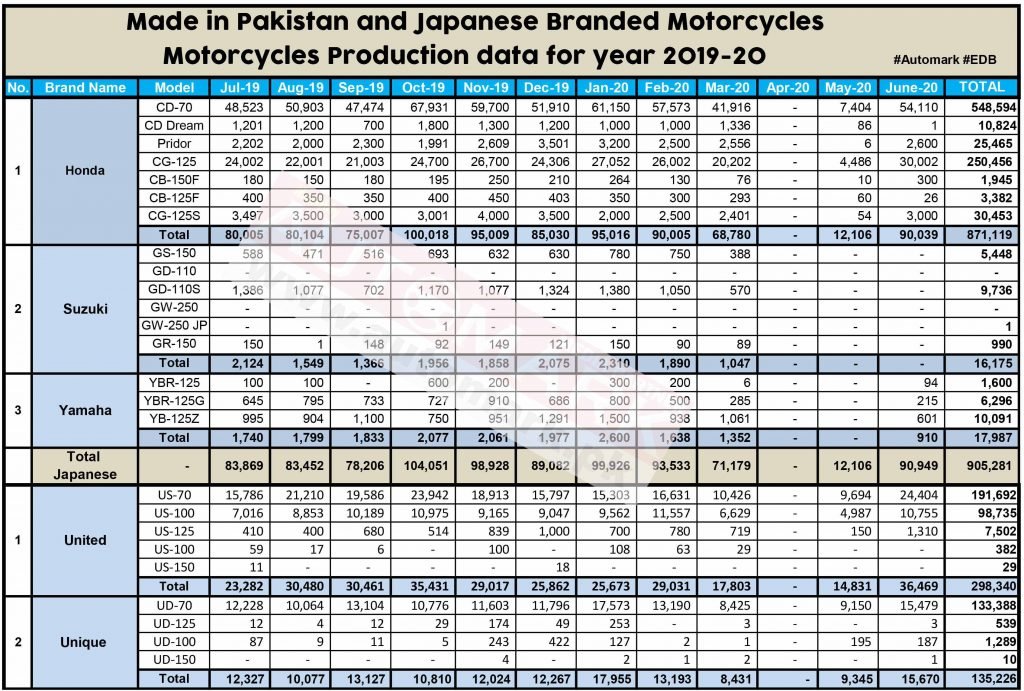

For instance, Atlas Honda Limited sold 179,003 units in 2MFY21 from 160,109 units in same period last fiscal while Suzuki and Yamaha sold 2,730 and 2,596 units versus 3,162 and 3,805 units in 2MFY21, showing a drop of 14 per cent and 32 per cent respectively.

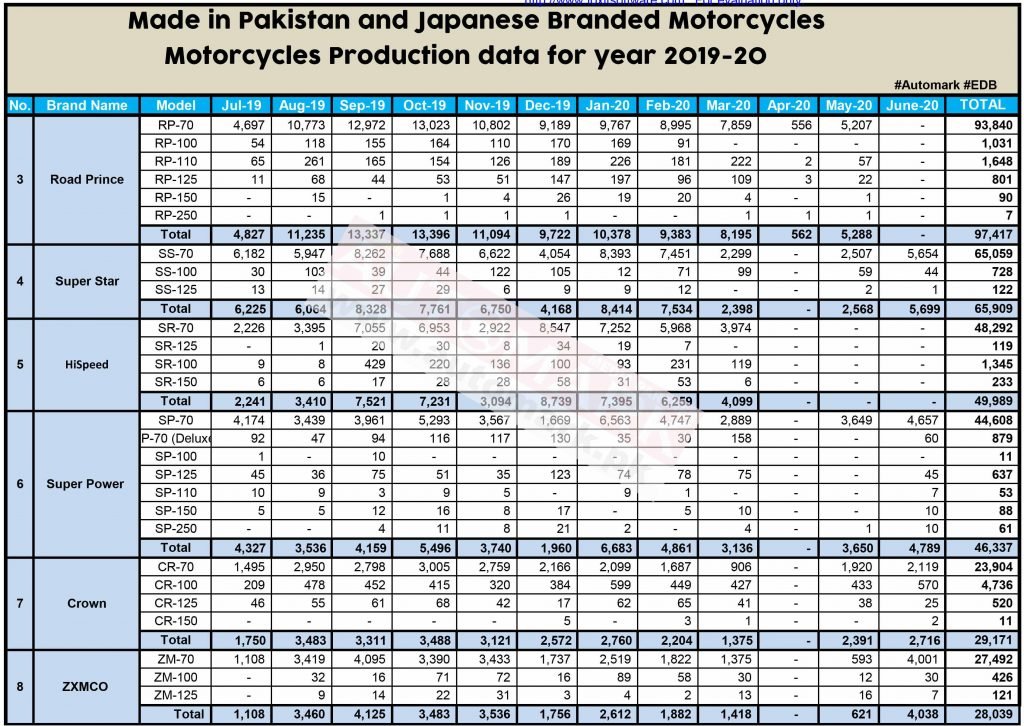

Road Prince and United Auto Motorcycle registered massive jump in sales to 25,120 and 70,419 units from 16,062 and 52,379 units, up by 56 per cent and 34 per cent respectively.

Chairman Association of Pakistan Motorcycle Assemblers (APMA), Mohammad Sabir Shaikh said the buyers are still upbeat in the markets during September. As a result, the markets are facing a shortage of two wheelers against soaring demand.

One of the reasons of shortage of bikes in the markets are slow supply of parts by the vendors to their respective manufacturing units followed by huge demand from the buyers due to lack of transport in big cities and poor conditions of taxis and rickshaws, he observed adding people avoid sitting in old vehicles and their fares also do not allow buyers to take risk under pandemic situation.

“The current quarter of July-September 2020 will end with a record production and sales in the bike industry especially,” Sabir hoped with confidence saying that bike sales on credit at the showrooms have also been thriving.

Like other countries, COVID-19 had hit Pakistan during March and many markets and industries remained closed for three months, resulting in massive unemployment in the country and pay cuts in industrial and private sector business units. As a result of the above situation, a booming two wheeler market remained subdued, APMA chief recalled.

The largest bike maker – Atlas Honda Limited, however, managed to roll out 871,119 units in FY20 followed by 298,340 by United Motorcycle. Unique by DS Motors rolled out 135,226 units while Road Prince made 97,417 units.

Super Star assembled 65,909 units while Hi Speed ended the 2019-2020 with production of 49,989 units. Super Power produced 46,337 units while Crown assembled 29,171 units.

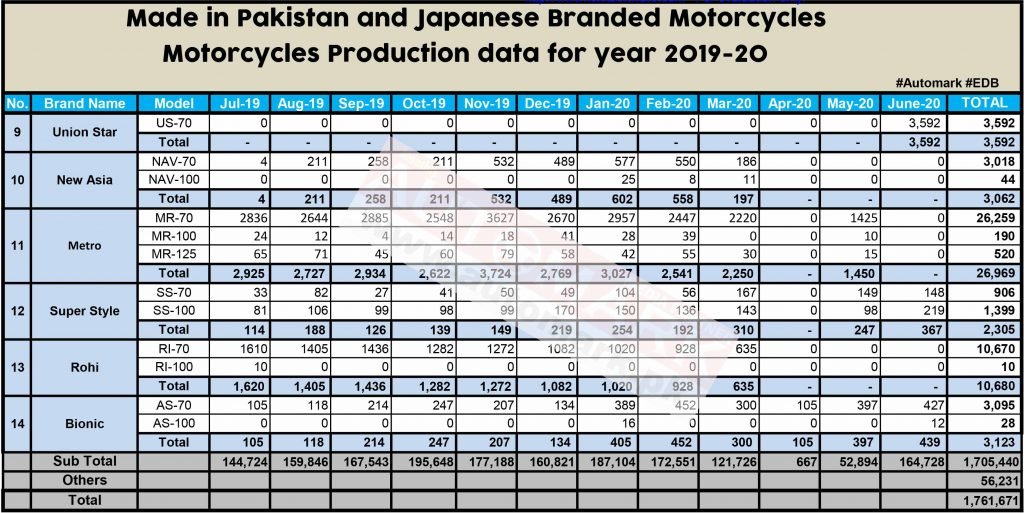

Zxmco and Metro made 28,039 and 26,969 units while Super Style, Roohi and Bionic produced 2305, 10,680 and 3,123 units.

Union Star bike assembler, a famous brand, declared 3,592 units in June 2020 while market sources said that the company had produced more than 60,000 units in 2019-2020. Some more than 20 small brands produced 56,231 units.

As per the date of Engineering Development Board (EDB), the country assembled 1.761 million units in FY20 while market sources said that the figures have exceeded 2.320 million units.

The market players have always remained skeptical about the actual or genuine production data as many companies are reportedly not sharing the true picture of their production to the government.

This is not the case in two wheelers’ industries as other industrial units are also playing with the figures.

The Federal Board of Revenue (FBR) has finally come up with an SRO on September 21, 2020 to check misdeclaration by the manufacturers and monitor and check genuine production of 30 different industrial sectors including motorcycles and auto rickshaws.

In a bid to curb ongoing rampant tax evasion, the FBR has made over 30 major manufacturing sectors “binding for installing electronic monitoring equipment at their premises to monitor real time production. “

The FBR has issued 889 (I) 2010 to amend the Sales Tax Rules, 2006. The manufacturers of over 30 major sectors are required to install “intelligent video analytics” at their premises for electronic monitoring of production on a real-time basis.

Sabir Sheikh said this SRO by the FBR may prove a game changer in unearthing real production data of various sectors depending on how the manufacturers really cooperate with the FBR.

Pak Suzuki Motor Company produced 16,175 units of two wheelers in FY20 followed by 17,987 units by Yamaha Pakistan.

Market sources said these two Japanese assemblers have never engaged in misdeclaration of production due to their market reputation. However, declining production of these assemblers have been attributed to strict rules and regulations and SOPs which they have been following since March. As a result, these two units have been operating with low staff and workers.

The models of these two companies are high priced due to low localization and higher imported parts and components.

Sabir Shaikh said the next quarter of the current fiscal year October to December may prove a good quarter keeping in view good crop prospects in cotton and higher prices.

According to the FBR’s issued rules, the provisions of these new rules shall apply to video surveillance for electronic monitoring of production on real-time basis. The production of specified goods, manufactured in Pakistan, shall be monitored through intelligent video surveillance, and video analytics by installation of equipment including video cameras, sensors, etc, at production lines, as are approved by the Board for real-time collection of data that shows production through object detection and object counting; transmission of data to central control room at the FBR on real-time basis, storage and archiving of data; detection of unexpected stops; quantitative analyses of productions and data analytics for required legal actions.

No person engaged in manufacturing of specified goods shall remove the production from its business premises unless it has undergone the process of intelligent video surveillance. The manufacturers of specified goods shall buy video monitoring equipment only from the authorized vendor. No manufacturer of the specified goods shall buy video monitoring equipment, which is not authorized or approved by the board. The FBR will set up an approval committee, which shall function in accordance with the provisions of these rules. The Project Director shall be the convener of the approval committee and its headquarters shall be located at the FBR House, Islamabad. The Board shall provide secretarial and other allied support required for functioning of the approval committee.

The approval committee shall devise procedures for its functioning, which shall be in accordance with these rules. The vendor shall be required to have and demonstrate ability to provide equipment with high security and efficiency for electronic monitoring of production and video analytics on real-time basis. The equipment offered by the vendor must have the following features including the equipment shall have high definition video camera and sensor that can record and count the production; the equipment shall have ability to weigh the product contained in bags; the equipment shall have ability to integrate with the software recommended by FBR which will be used for transmission of data to central control room; the equipment will conduct video analytics and communicate results thereof to central control room(CCR); the equipment will report any unauthorized stoppages of production through generation of appropriate alarm; the system should have sixty days remotely retrievable local, on-site, and at place, specified by the Board, off-site, data storage at each site; the CCR should have a central data storage capacity capable of storing and retrieving data on long term basis up to five years and the equipment must be stable, fault-tolerant, secure and accessible only by username and password as authorized by the Board.

Sabir said the Excise and Taxation Department, Sindh, has not been providing registration numbers of all brands on a monthly basis to the media and other concerned departments. It is important that how many brands are being registered in the biggest city of Pakistan – Karachi – as there is a need to study the last five years data of registered bikes in Karachi.

This exclusive article has been published in Automark Magazine’s printed edition of October-2020