Dear Readers the BYD PHEV SEALION 6 has emerged as a standout model in the world of hybrid vehicles, boasting a range of innovative features and claims that set it apart from its competitors. This article delves into what makes the SEALION 6 unique, why BYD refers to it as a “super hybrid,” its economic advantages, the recharging mechanisms it employs, and its success in various markets.

What Makes the BYD PHEV SEALION 6 Unique?

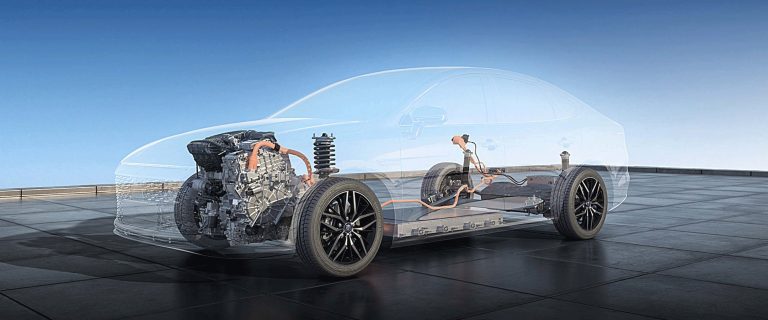

The BYD PHEV SEALION 6 is a plug-in hybrid electric vehicle (PHEV) that integrates several advanced technologies to deliver a distinctive driving experience. Its uniqueness can be attributed to:

1. Advanced Hybrid Technology:

The SEALION 6 features BYD’s latest hybrid technology, which combines a highly efficient internal combustion engine with an electric motor. This dual powertrain system allows the vehicle to switch seamlessly between electric and gasoline power, optimizing performance and fuel efficiency based on driving conditions.

2. Enhanced Battery Capacity:

One of the standout features of the SEALION 6 is its impressive 18.3 kWh battery. This larger battery provides a substantial all-electric range, enabling drivers to cover longer distances on electric power alone before needing to rely on the gasoline engine. This feature not only enhances the vehicle’s environmental credentials but also reduces the frequency of recharging.

3. Cutting-Edge Design:

The SEALION 6 incorporates BYD’s signature design elements, including a sleek, aerodynamic body and a high-tech interior. The vehicle’s design is aimed at reducing drag and improving overall efficiency. The spacious interior, coupled with advanced infotainment and driver-assistance systems, provides a comfortable and connected driving experience.

4. Energy Efficiency: The hybrid system in the SEALION 6 is designed to maximize energy efficiency. It features regenerative braking technology, which captures energy during braking and stores it in the battery. This system not only extends the vehicle’s electric range but also enhances overall efficiency.

Why Does BYD Call It a Super Hybrid Vehicle?

BYD describes the SEALION 6 as a “super hybrid” due to several key factors:

1. Superior Efficiency:

The term “super hybrid” reflects the SEALION 6’s advanced hybrid technology that delivers exceptional fuel efficiency and reduced emissions. The vehicle’s ability to operate on electric power for extended periods and its high overall efficiency contribute to its classification.

2. Innovative Hybrid System:

The SEALION 6 utilizes a sophisticated hybrid system that optimizes the use of electric and gasoline power. This system not only improves fuel economy but also enhances performance, making the vehicle suitable for a variety of driving conditions.

3. Extended Electric Range:

With its large 18.3 kWh battery, the SEALION 6 offers a longer all-electric range compared to many other hybrid vehicles. This extended range reduces the need for frequent recharging and makes the vehicle more practical for long-distance travel.

4. Advanced Features:

The SEALION 6 is equipped with a range of advanced features that enhance its hybrid capabilities. These include smart energy management systems, regenerative braking, and a comprehensive suite of driver-assistance technologies.

Economic Advantages of the BYD PHEV SEALION 6

BYD’s claim that the SEALION 6 is the most economical hybrid model is based on several factors:

1. Fuel Efficiency:

The SEALION 6’s hybrid system is designed to achieve high fuel efficiency. By combining electric and gasoline power, the vehicle reduces overall fuel consumption and emissions. The ability to drive longer distances on electric power alone further enhances its fuel efficiency.

2. Cost Savings:

Owners of the SEALION 6 can benefit from lower fuel costs due to its hybrid nature. The vehicle’s electric driving capability reduces reliance on gasoline, which can lead to significant savings over time, especially for drivers who primarily use the vehicle for short trips or commutes.

3. Government Incentives:

In many regions, plug-in hybrid vehicles like the SEALION 6 qualify for government incentives and tax credits. These incentives can further reduce the overall cost of ownership and make the SEALION 6 a more attractive option for cost-conscious buyers.

4. Long-Term Value:

The SEALION 6 is designed to be durable and reliable, which can contribute to lower maintenance and repair costs. The combination of advanced engineering and high-quality components ensures that the vehicle remains a cost-effective choice over its lifespan.

Recharging Mechanisms for the PHEV SEALION 6

The SEALION 6 is equipped with several sources and channels for recharging its 18.3 kWh battery while traveling long distances:

1. Home Charging:

The primary method for recharging the SEALION 6 is through a standard home charging setup. This allows owners to charge the vehicle overnight, ensuring that the battery is fully charged before embarking on long journeys.

2. Public Charging Stations:

The SEALION 6 can be recharged at public charging stations, which are increasingly available in many urban and rural areas. These stations offer varying levels of charging speed, including fast chargers that can quickly replenish the battery.

3. Regenerative Braking:

The vehicle’s regenerative braking system captures energy during braking and converts it into electricity to recharge the battery. This process helps extend the vehicle’s range and improves overall efficiency.

4. On-the-Go Charging Solutions:

In some regions, BYD offers on-the-go charging solutions such as mobile charging units or partnerships with charging network providers. These solutions can help drivers find charging options during long trips and ensure that they can continue their journey with minimal interruptions.

Success in Various Markets

The BYD SEALION 6 has achieved notable success in several countries, where it stands out in comparison to its competition. Key markets where the SEALION 6 has been well-received include:

1. China:

In its home market of China, the SEALION 6 has gained significant popularity due to BYD’s strong brand presence and the country’s supportive policies for electric and hybrid vehicles. The vehicle’s advanced technology and competitive pricing have contributed to its success in this market.

2. Europe:

The SEALION 6 has also made a mark in various European countries, where there is a growing demand for hybrid and electric vehicles. European consumers appreciate the vehicle’s efficiency, advanced features, and environmental benefits, which align with the region’s focus on sustainable transportation.

3. North America:

In North America, the SEALION 6 faces stiff competition but has managed to carve out a niche among environmentally conscious consumers. The vehicle’s cost savings, extended electric range, and advanced hybrid technology resonate with buyers looking for an economical and eco-friendly option.

Competition

The BYD PHEV SEALION 6 faces competition from several key players in the hybrid vehicle market. Its direct competitors include:

1. Toyota RAV4 Prime:

The Toyota RAV4 Prime is a popular plug-in hybrid SUV known for its impressive electric range and overall efficiency. It competes with the SEALION 6 in terms of technology, performance, and market appeal.

2. Mitsubishi Outlander PHEV:

The Mitsubishi Outlander PHEV is another strong competitor, offering a blend of electric and gasoline power with a focus on practicality and versatility. Its established presence in the market makes it a significant rival to the SEALION 6.

3. Ford Escape Plug-In Hybrid:

The Ford Escape Plug-In Hybrid provides a competitive alternative with its own set of advanced features and hybrid technology. It targets a similar demographic as the SEALION 6 and offers comparable benefits.

4. Hyundai Tucson Plug-In Hybrid:

The Hyundai Tucson Plug-In Hybrid offers a strong value proposition with its hybrid technology, stylish design, and practical features. It competes with the SEALION 6 in terms of performance and overall appeal.

Conclusion

The BYD PHEV SEALION 6 stands out in the hybrid vehicle market due to its advanced technology, economic advantages, and innovative recharging mechanisms. BYD’s classification of the SEALION 6 as a “super hybrid” highlights its superior efficiency and extended electric range. The vehicle’s success in various markets underscores its competitive edge, despite facing strong competition from established players. As hybrid and electric vehicles continue to gain traction, the SEALION 6’s unique features and advantages position it as a noteworthy option for discerning buyers.

This exclusive article has been written by Aqeel Bashir and published in Automark magazine’s September-2024 printed/digital edition.